Aged Analysis

Aged Analysis

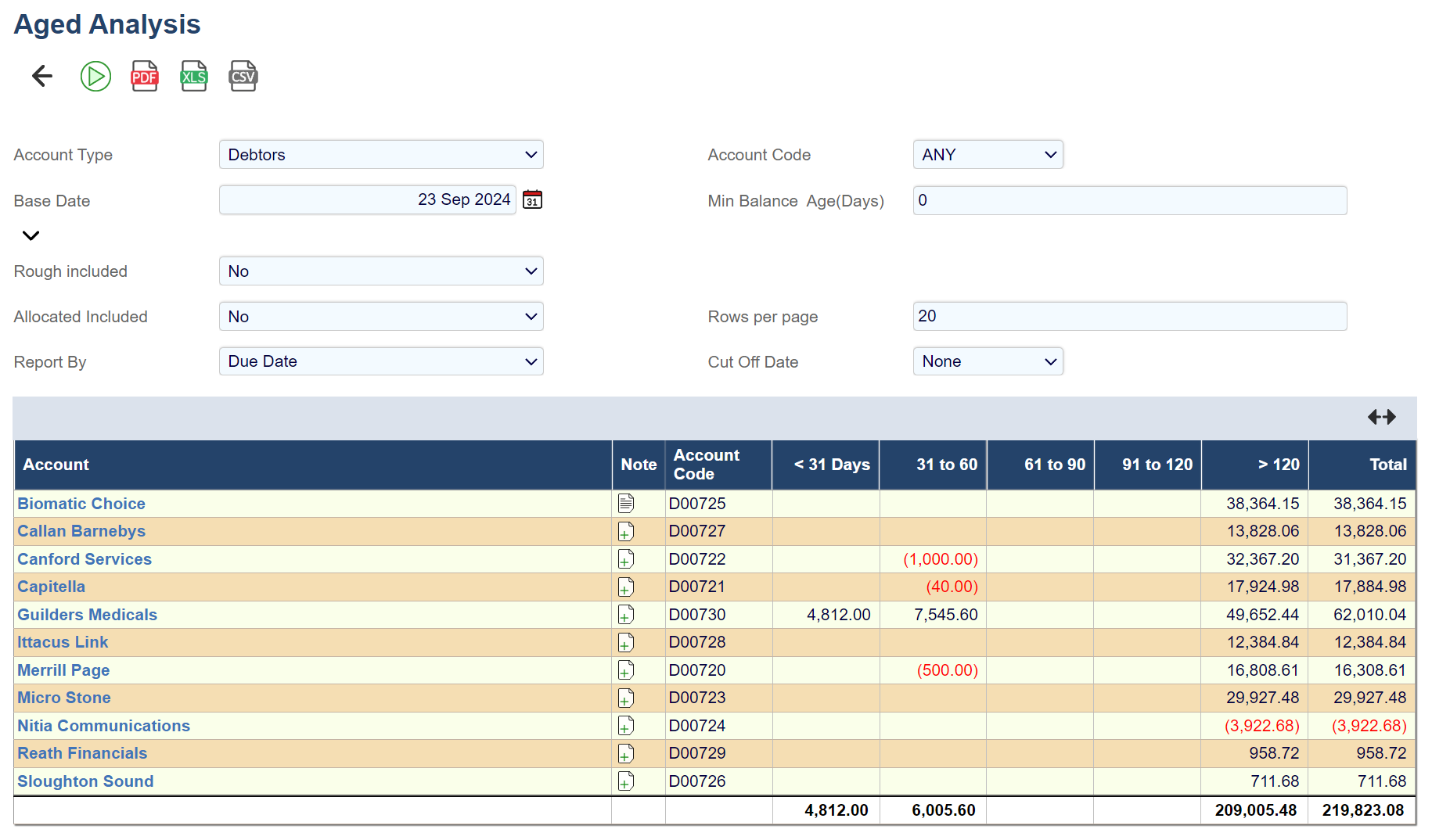

This report enables you to quickly analyse your payables and your receivables for debt management and cash flow analysis purposes. The report analyses debtor or creditor accounts by five ageing periods.

Less than 31 days | 31-60 days | 61-90 days | 91-120 days | More than 120 days |

|---|

The report parameters are shown below:

Field | Description |

|---|---|

Account Type | The report may be run for debtors or creditors. |

Base Date | Reports are aged backwards from the base date. |

Rough Included | If Yes rough posted transactions are included; otherwise they are not. |

Report Profile | The only current option is standard. |

Allocated Included | If Yes allocated transactions are included; otherwise they are not. |

Rows per Page | Determines the number of rows per page. |

Report By | Transactions can be aged by transaction date or due date. |

Cut Off Date | The Cut-Off Date typically affects what is included in the first column of the report.

|

The report is commonly used for:

Credit control and cashflow analysis

Showing aged analysis of balance sheet balances

For these purposes the normal selections are:

Credit control and cashflow analysis

Report By | Due Date |

Allocated Included | No |

Cut Off Date | None |

Showing aged analysis of balance sheet balances

Report By | Transaction Date |

Allocated Included | Yes |

Cut Off Date | Base Date |

The aged analysis will not match the balance sheet if any transactions have been posted out of period. For example, if a late invoice for December is posted into the January period, the balance sheet will exclude the invoice from the December report but the aged analysis will include the invoice.

The aged analysis will not show nil balances if you do not include allocated transactions and transactions are matched off in the individual accounts.

The report ignores any corrected transactions created by the journal correction function.