VAT Rates & Reverse VAT

VAT Rates & Reverse VAT

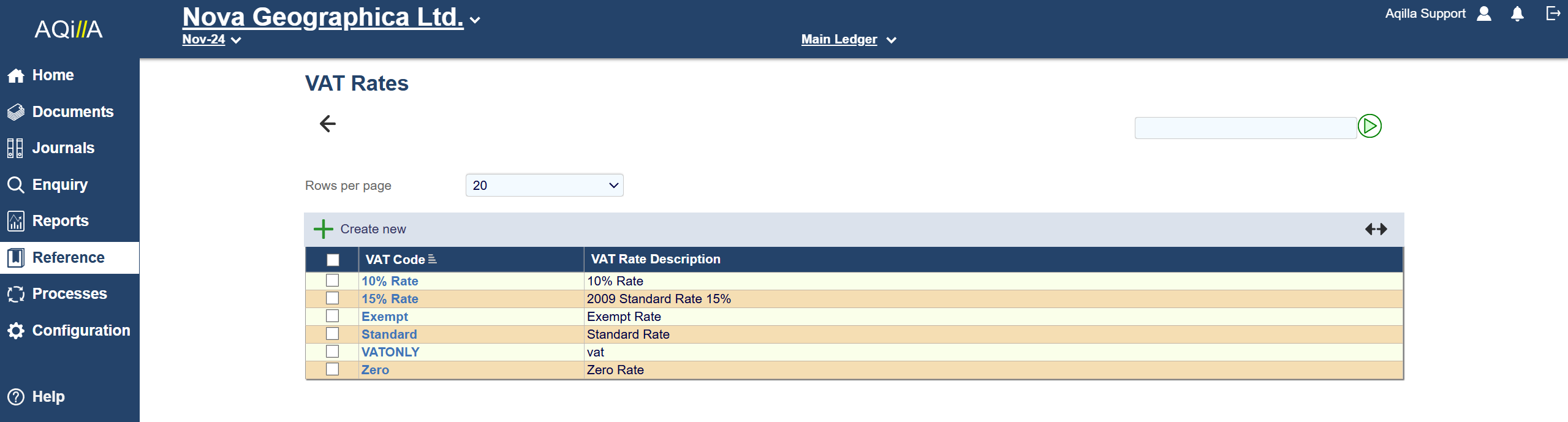

The page allows you to create VAT Rates and specify which documents can use them.

The Vat code and description are for Aqilla and will help you identify the VAT code. Eg. Standard 20%

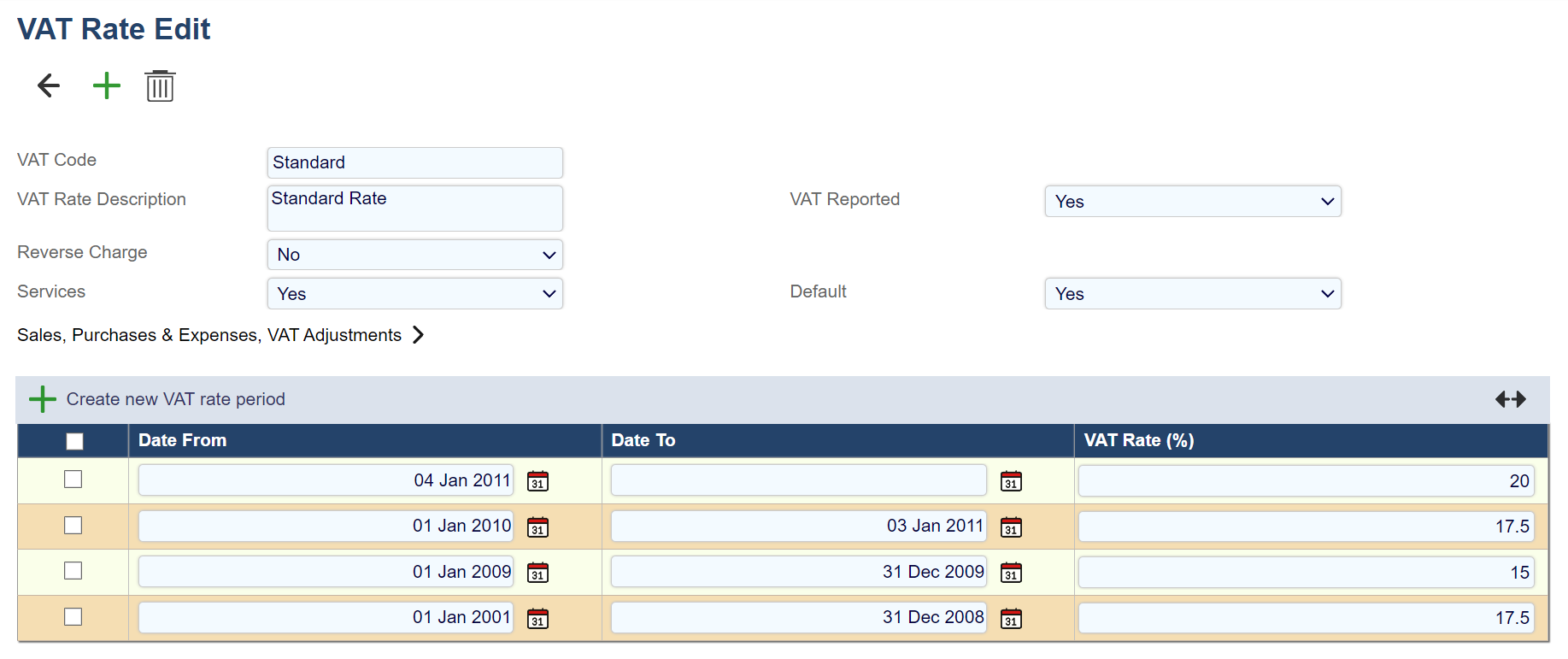

VAT Rate Edit

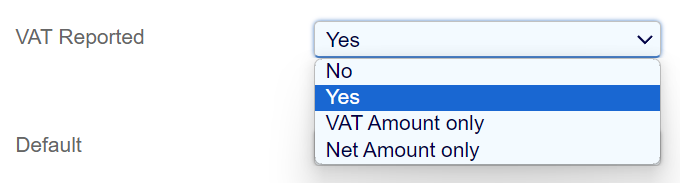

VAT reported

(Yes/No, VAT Amount Only, NET Amount Only) is an important field, and only choose No if you have a VAT exemption and the VAT is not meant to be reported.

Options:

VAT Reported - Yes: Records the VAT amount on the VAT account

VAT Reported - No: Excludes the VAT amount on the VAT Account

VAT Reported - VAT Amount Only: Only Records the VAT amount. The VAT report will not pick up the NET Amount.

VAT Reported - NET Amount Only: Only Records the NET Amount. The VAT report will not pick up the VAT amount.

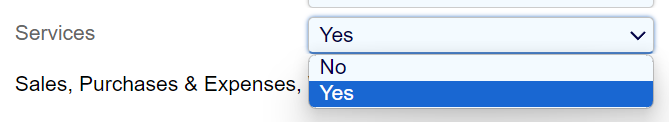

Services

This determines if this VAT is for a physical product or a service that is being reported on.

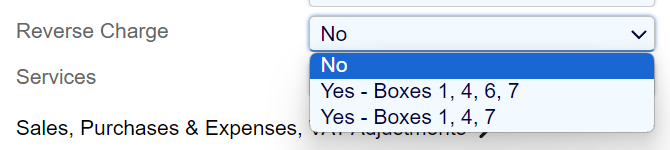

Reverse charge VAT

The reverse VAT rate is reporting an expected VAT rate on someone else's behalf. Please note that a Reverse Charge Vat Rate must have a value of 0 in the VAT Rate Period, otherwise you are reporting a VAT rate for yourself as well as your supplier

The reverse charge field has three options, as well as opening up a new field [Standard Rate] for you to fill out with the expected VAT rate of your supplier.

The three options for Reverse Charge is:

No

Yes - Boxes 1, 4, 6, 7

Yes - Boxes 1, 4 , 7

Select the one that is most applicable to you.

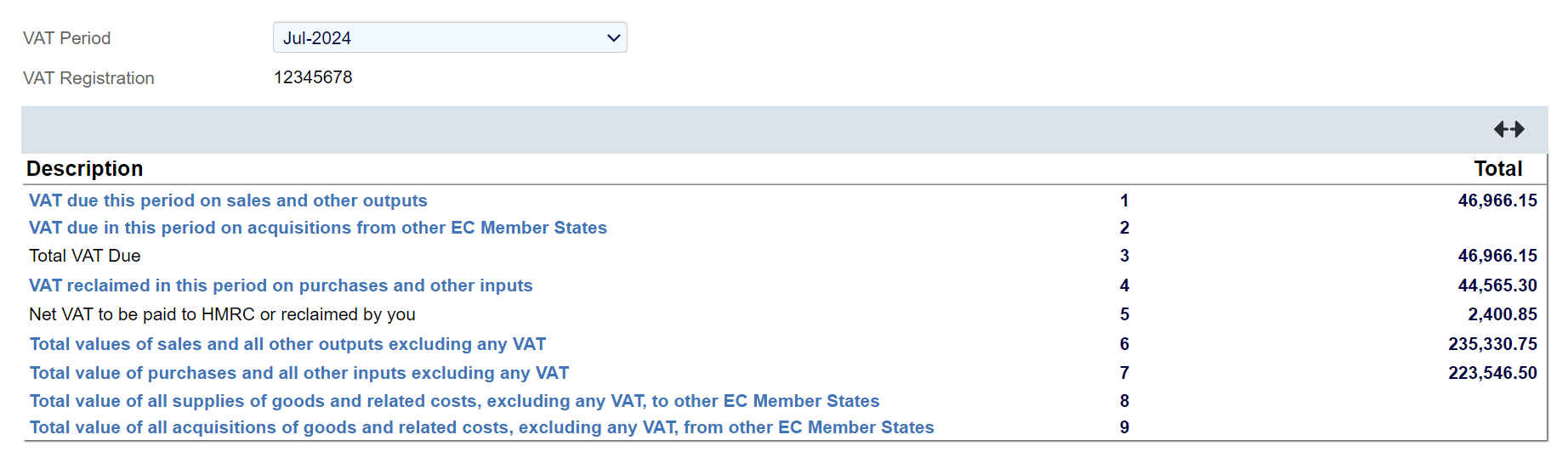

You can see the boxes in Reports > VAT100 Report

This should be set to No for a standard rate.

Boxes shown in he VAT 100 Report

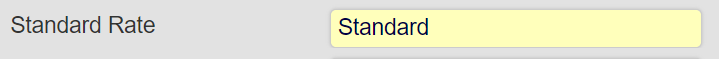

Standard Rate

This field is only available when Reverse Charge is selected and it is here you select a VAT rate from Aqilla (I.E. Standard 20%) that you expect your supplier to pay.

This field is only applicable to your supplier, and not to your VAT return.

For example. Standard Rate would be a 20% VAT Rate that you pass on to your Supplier.

Your own VAT will not record a value on the VAT account if you have done this correctly.

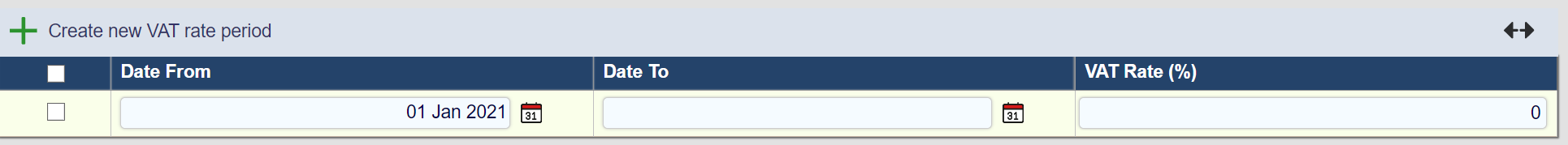

To avoid reporting the same VAT amount twice, please set the VAT rate to 0 as seen on the right.

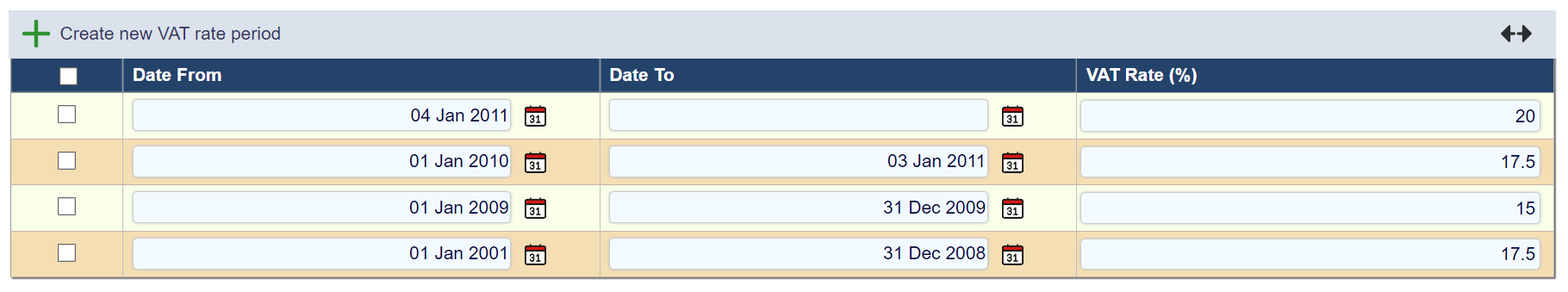

VAT Periods

The bottom of the page holds the VAT period fields. These fields contain the FROM and TO dates, as well as the VAT Rate %

You can leave the TO field open, this prevents your VAT rate from expiring within the system.

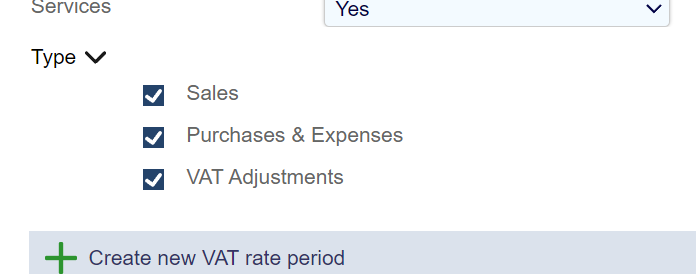

VAT Rate Applicability

These options allows you to set which document type the VAT rate is available on.

A VAT rate will not be available on a document type if the box below is not ticked.

If you are looking for a specific VAT rate on your document and you cannot see it, then this is a good place to look.

VAT Rate Edit Fields

Each field on this record is described below. Mandatory fields are highlighted thus.

Field Name | Description |

|---|---|

VAT Code | The name of the VAT code. |

VAT Rate Description | The description of the VAT rate. |

Reported | No, Yes, VAT Amount only or Net Amount only. |

Reverse Charge | (Yes - Boxes 1, 4 , 6 , 7)/ (Yes - Boxes 1 , 4 , 7) or No. |

Standard Rate | This only appears if Reverse Charge is set to Yes. |

Services | Yes or No. (This selects if you are reporting VAT on a physical product or a service) |

Default | Yes or No (only one by definition). Is this VAT Code displayed on a document by default? |

For each VAT Code, rates can be defined which apply to a specific time span; see screenshot above. If you want to apply a rate without a time limit, just enter Date From and leave Date To blank - this by default is the current rate.

You can enter future VAT rates as soon as they are announced; these will automatically take effect from the Date From date you enter.