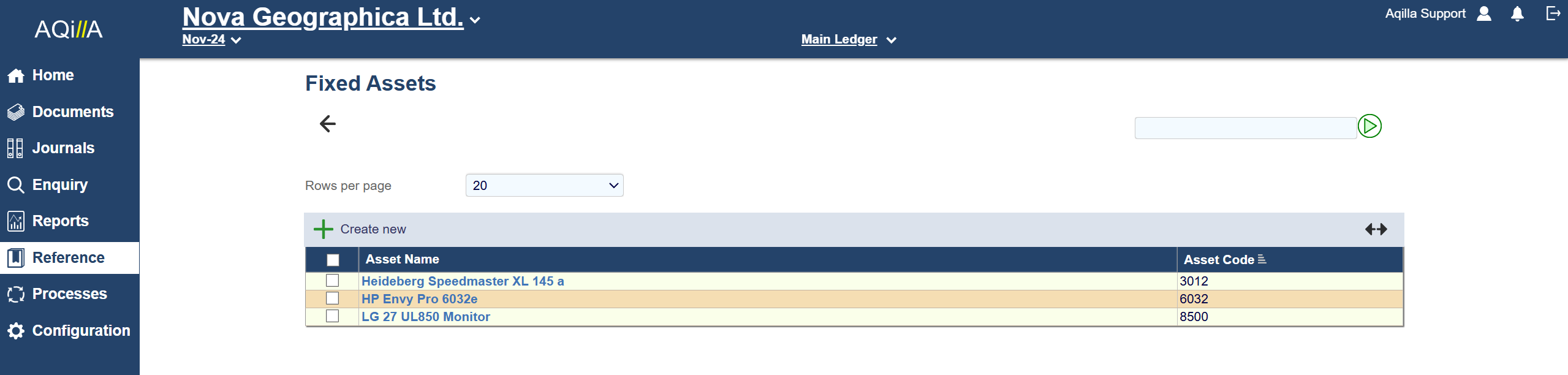

Fixed Assets (Deprecated)

The functionality of this page has been replaced by our Fixed Asset Register

Fixed Asset Fields

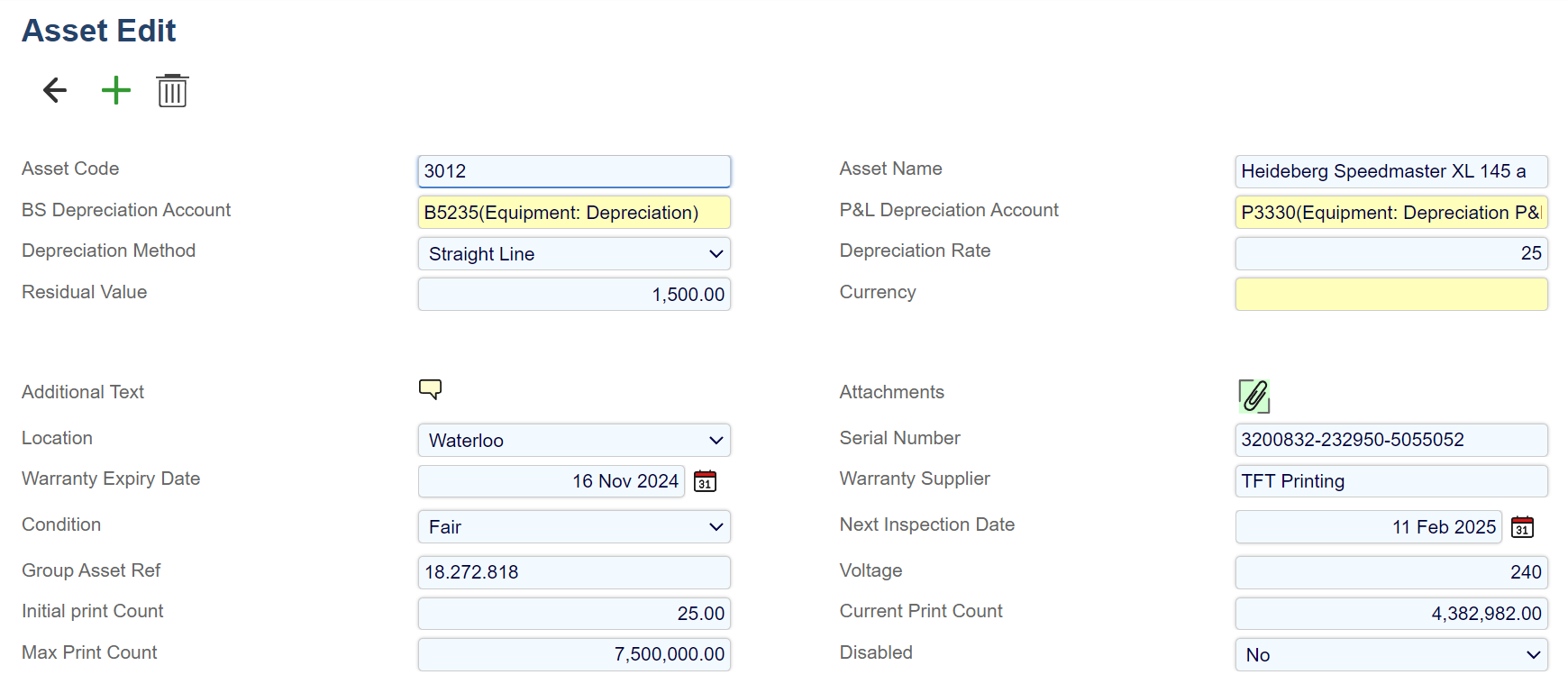

A sample Fixed Asset - Details view is shown below:

Each standard field on this record is described below. Mandatory fields are highlighted thus.

Field Name | Description |

|---|---|

Fixed Asset Name | The name of the fixed asset - max 60 characters (alphanumeric). |

Code | A code for the asset - max 30 characters (alphanumeric). |

BS Depreciation Account | Self-explanatory. |

P&L Depreciation Account | Self-explanatory. |

Depreciation Method | No Depreciation, Straight Line or Reducing Balance. |

Depreciation Rate | A decimal number. |

Residual Value | The estimated residual value of an asset at the end of its service life. |

Currency | The currency in which the asset is valued. |

Notes | Notes about the asset. |

Attachment | An attachment about the asset. |

Disabled | Yes or No. |

No processing is associated with this function; it is for reference only. The standard asset view is shown above; additional attributes can be created using Configuration > Attribute Wizard.

Depreciation is usually calculated in MS Excel by reference to this record (and other additional attributes) and entered into Aqilla using the Aqilla MS Excel Add-in.