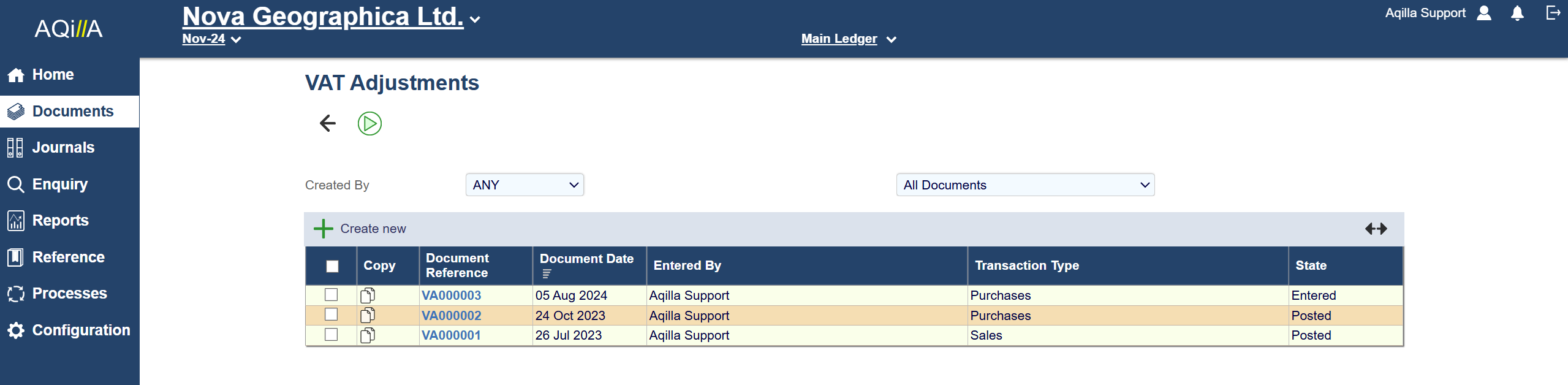

VAT Adjustments

With the introduction of HMRC MTD, it will no longer be possible to make adjustments to a VAT return outside Aqilla. This has particular significance for organisations that apply partial VAT recovery where it is necessary to apply changes to the amount of VAT reclaimed either on a quarterly or annual basis.

A new VAT Adjustment Document is available to make adjustments to calculated VAT summary data prior to the submission of a VAT return. This document is required because only certain document types are recognised by the VAT reporting functionality, specifically: Sales and Purchase Invoices, Expenses, and now in addition VAT Adjustments.

New settings are available in the VAT Rates definition to specify whether the VAT reports will include a) both the Net and VAT amounts; b) just the VAT amount or, c) just the Net amount. Please see VAT Rates.

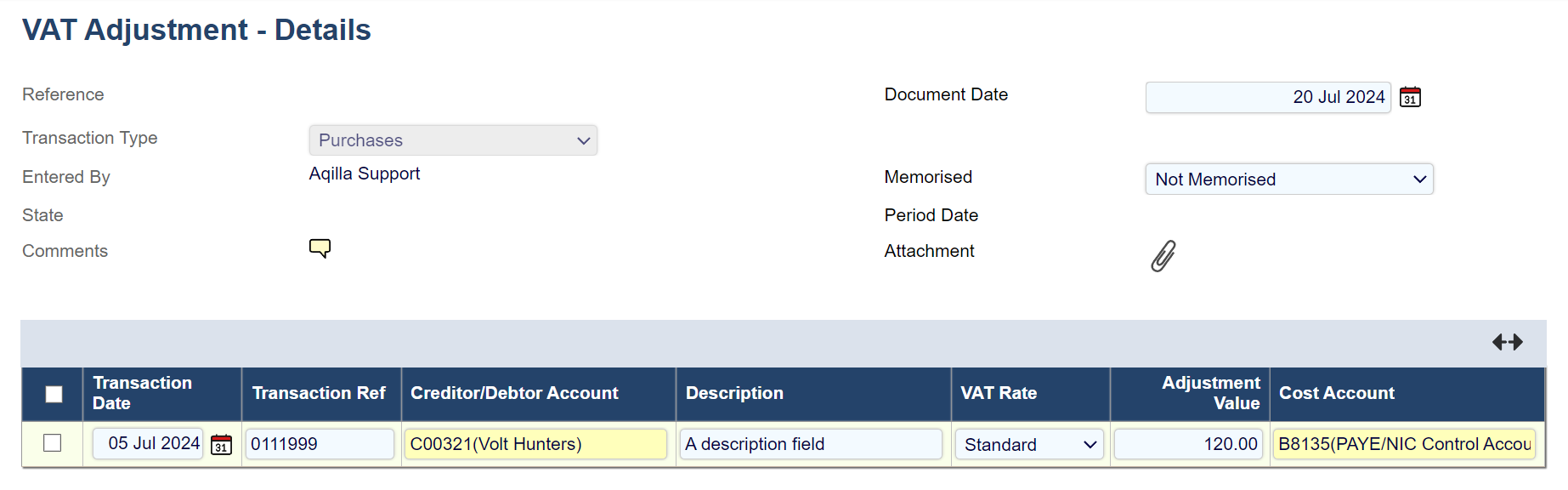

VAT Adjustment - Details

Each field on this document's header is described below.

Field Name | Description |

|---|---|

Document Date | The document date defaults to the current date but this can be amended by the user. |

Document Reference | The document reference is automatically assigned by Aqilla. |

Transaction Type | Purchase or Sales: This option changes the document lines between creditor and debtor and has an impact on what account you are adjusting. |

State | The state of the document: E.g. Entered, Released, Rough-Posted, Posted |

Entered By | The name of the user who entered this document is automatically assigned by Aqilla. |

Memorised | See Documents. |

The VAT Adjustment document consists of a header and one or more detail lines. The document is also supported by the Excel Add-in to simplify the creation of multiple adjustments.

The header is mainly to group together a set of adjustments for a VAT period and has options to attach a file and add comments that could be later used as a backup to the calculations. Like other Aqilla documents, the header and details can be configured with additional user attributes.

The details of the document could be entered in one of two ways:

A single adjustment figure for all adjustments for the period and rely on a separate descriptive document to identify the details of the adjustments. This has the advantage of the simplicity of entry but any analysis of the adjustments would be very limited.

Each adjustment is entered line by line referencing back to the original document through the Transaction Reference. This would provide a detailed audit trail within Aqilla and enable any analysis to be carried through to the adjustments.

If the Transaction Date and Transaction Reference match an existing transaction posted to the ledger, the document will automatically look up the creditor or debtor account, otherwise, details can be entered manually.

Partial VAT

The treatment of partial VAT recovery does vary from customer to another and you may require some help from a consultant but the basics are as follows:

|

|---|

|

|

|

|

The resulting journal will be:

Credit the VAT input account

Debit the cost account

Zero to the creditor account

Users can see details of transactions by drilling down from the HMRC VAT MTD report or going directly to the VAT Detail Enquiry. However, with the MTD implementation, the report needs to be deleted and recreated to see any changes since the previous time the VAT report was created. This can be run as many times as required until the report is finally submitted to HMRC.

Rates that change quarterly

Rates that are changed quarterly can also be applied via the VAT Adjustment document.

For example, if the original invoice is recording VAT at 20% but at the end of the quarter it is determined that only 5% can be recovered, then each affected document needs to be adjusted by 15%.

Although partial VAT recovery is likely to be the main use of this document, there are other situations where adjustments could be used such as when dealing with VAT with countries outside the EU.