Company

Introduction to Companies

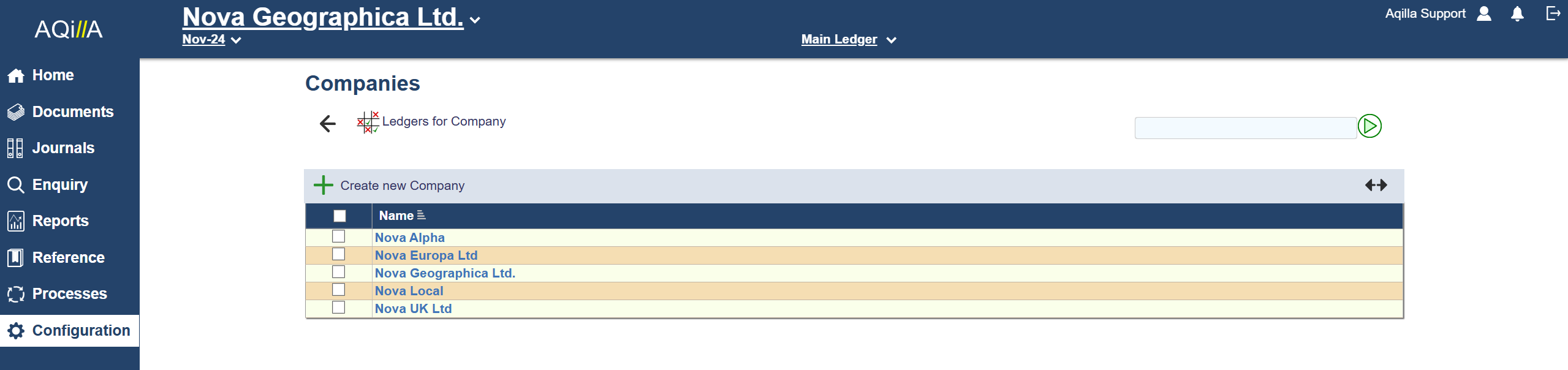

You can account for any number of companies in an Aqilla instance. Companies are maintained at Configuration > Companies:

For an overview of accounting for multiple companies in Aqilla see Articles > Multi-Company Accounting.

Company Details

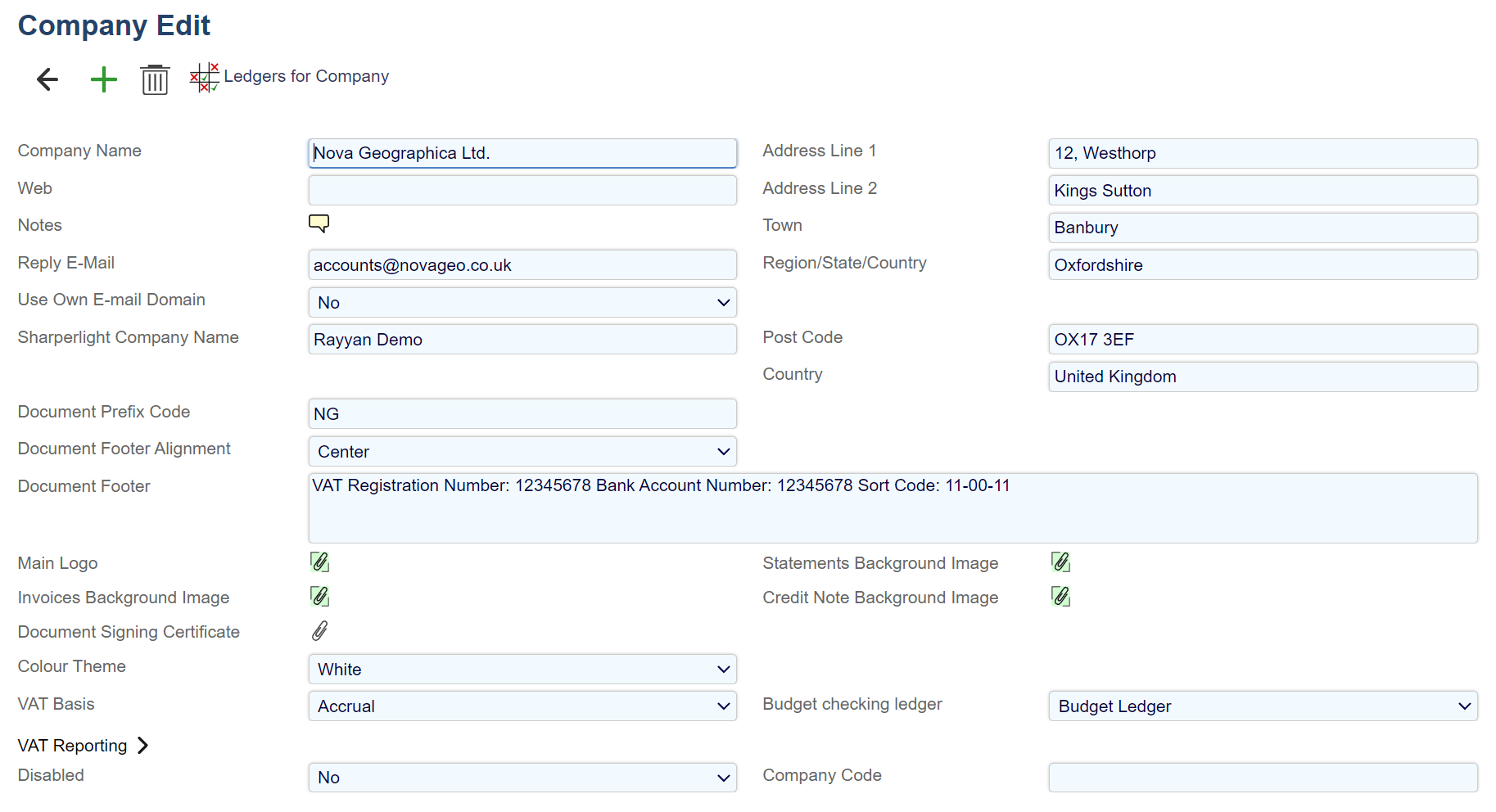

This function is used to maintain basic details about a company in an Aqilla instance (whether one company per instance or many companies per instance). A sample Company Edit view - excluding Contacts - is shown below:

Field | Description |

|---|---|

Company Name | The name of the company - (Max 60 alphanumeric characters) |

Address | 4 Address lines + Post Code and Country - (Max 60 alphanumeric characters per line) |

Web | Website URL. |

Notes | Free text - practically unlimited. |

Reply E-Mail | The e-mail address from which a document sent from Aqilla will appear to be sent. This option requires you to register with our email service provider and verify your Reply E-mail. Contact Aqilla for more information. |

Payments Export Format | This field allows you to choose the format of your payment file. |

Document Footer Alignment | Allows you to pick the location of your Document Footer. (Left, right or Centre) |

Document Footer | Text field that shows up on your printed document. The footer on a printed document typically shows VAT and / or company registration number. |

Main Logo | The main logo for your documents. It will show in the top right hand corner on your printed documents. The image should be supplied with a minimum size of 60 pixels high and between 60 and 225 pixels wide depending on the shape of the logo. Larger images will mean that the document can be magnified more without loss of the image quality. Since PDF viewers will often display a document magnified to 200%, 120 x 450 pixels is probably the optimum for clarity and document size. The format of the image should ideally be .PNG but .JPG is also acceptable. |

Statements Background Image | The background image will show up behind the header and table on your Statement of Accounts. |

Invoices Background Image | The background image will show up behind the header and table on your invoices. |

Credit Notes Background Image | The background image will show up behind the header and table on your Credit Notes. |

VAT Basis | Selection of VAT options. (No VAT, Accrual or Cash Basis) No VAT disables VAT reporting for the company and no transactions will be recorded on the Sales and Purchase VAT accounts. |

Reporting Periods | Selection of how often you wish report VAT (Monthly, Bi-Monthly, Quarterly or Annually.) The generated VAT report will all the transactions for the relevant months in the VAT report. |

First Period Ends | When your first VAT period Ends. |

Last Return Date | Automatically set by running Reports > VAT 100 Report. |

Purchases + Sales VAT Account | The general ledger account to which you post Sales VAT and Purchase VAT. The VAT return is generated based on the VAT accounts. Please keep in mind that changing the VAT accounts can have an impact on your VAT return. It is recommended that changing VAT accounts only happens at the end of a VAT Period. |

VAT Registration | The company VAT Registration Number. This must be the same VAT Registration Number provided by HMRC. |

Disabled | The setting of this flag will prevent access to the company, and Aqilla will no longer charge for the company. Data will be archived and stored for a disabled company and if necessary, it can be re-enable by sending an email to Aqilla support (support@aqilla.com). A company usage charge is for a minimum of one month. An instance must always have at least one active company. |

If you are not registered for Making Tax Digital

You will create your VAT return as described at Reports > VAT 100 Report and that report will use the parameters you set up here. The VAT 100 Report is used to prepare VAT returns for submission to HMRC. It is only applicable if your organisation is VAT registered with HMRC. If you need to prepare VAT returns for another jurisdiction please contact your Aqilla consultant or account manager.

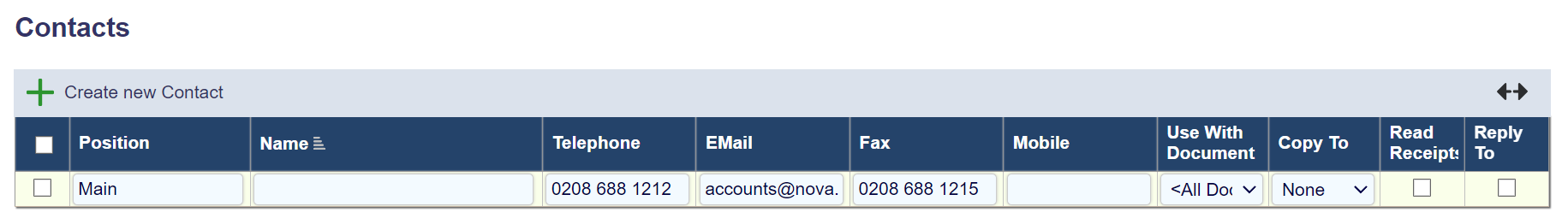

Company Contacts

You can store any number of contacts for your organisation. Contacts are primarily used to record who will receive copies of documents e-mailed from Aqilla and the contact details displayed within such documents.

Each field on this record is described below. Mandatory fields are highlighted thus.

Fields | Description |

|---|---|

Position | A position - max 60 alphanumeric characters. |

Name | A name - max 60 alphanumeric characters. |

Telephone | A phone number - max 60 alphanumeric characters. |

An e-mail address - max 60 alphanumeric characters. | |

Fax | A fax number - max 60 alphanumeric characters. |

Use With Document | All or one from Creditor Remittance, Debtor Statement, Sales Invoice, Purchase Order |

Copy To | None, CC, BCC - are documents to be sent to the e-mail address for this row and if so, how? |

Read Receipts | Yes or No - are read receipts to be returned? |

Note that Aqilla does not store copies of e-mails sent to customers and suppliers. If you want to be able to see history of sent e-mails you will need to copy e-mails to an inbox that you control.