VAT 100 Report

VAT 100 Report

Please also read Making Tax Digital alongside this page.

The VAT 100 Report is used to prepare VAT returns for submission to HMRC. It is only applicable if your organisation is VAT registered with HMRC. If you need to prepare VAT returns for another jurisdiction please contact your Aqilla consultant or account manager. The VAT 100 report view can display reports created through the MTD process. This avoids the need to log into HMRC to be able to view the reports.

To set up your basic VAT details use Configuration > Companies. VAT Rates are maintained at Reference > VAT Rates.

Only transactions posted through Sales Invoices, Purchase Invoices, Credit Notes or Expenses (under Documents) will be included in the VAT 100 Report (or if you are running Purchase Orders any transactions posted through Purchase Invoice Matching). Manual postings into VAT accounts through Miscellaneous documents will not be included into the VAT 100 Report. Such amounts will have to be added manually before transcribing the Input and Output totals into the report to be submitted to HMRC.

The standard VAT 100 Report parameters are:

VAT Period Ending Date | Self-explanatory. |

VAT Registration | Maintained at Configuration > Companies. |

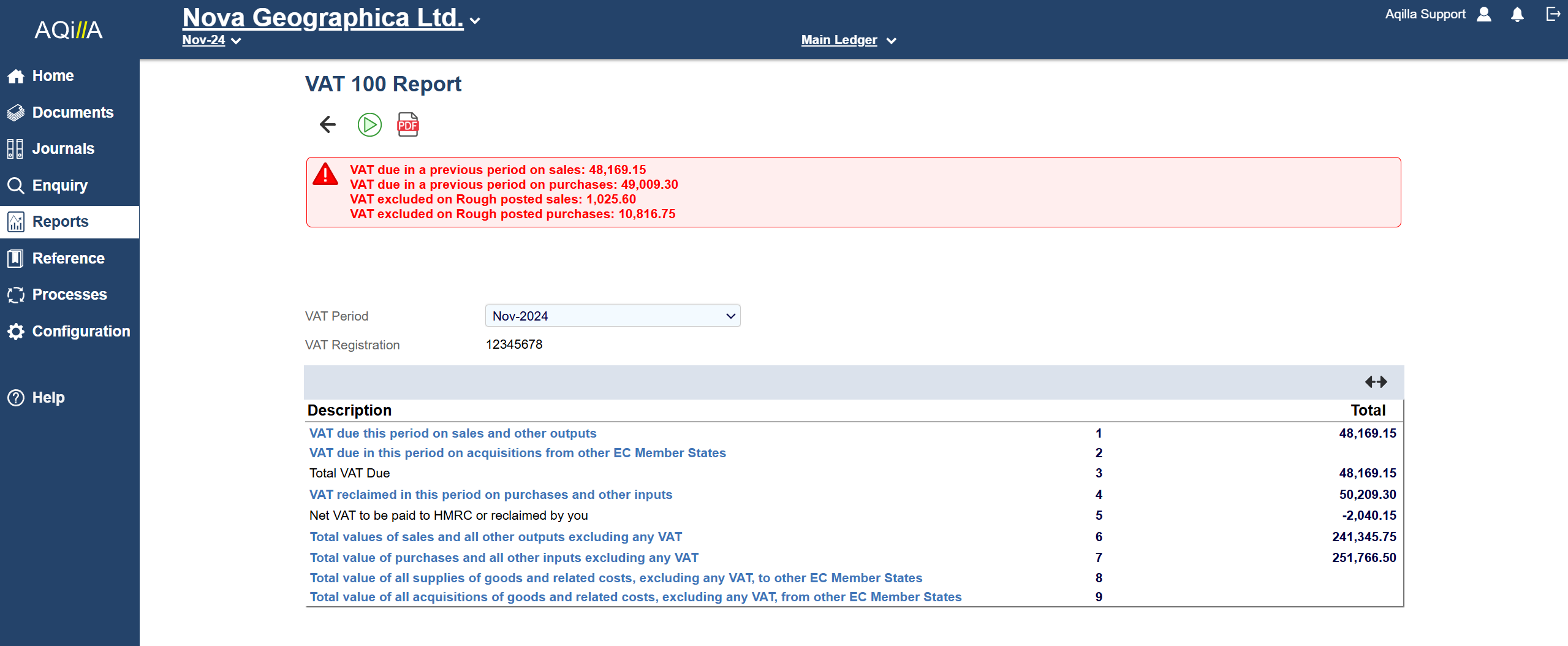

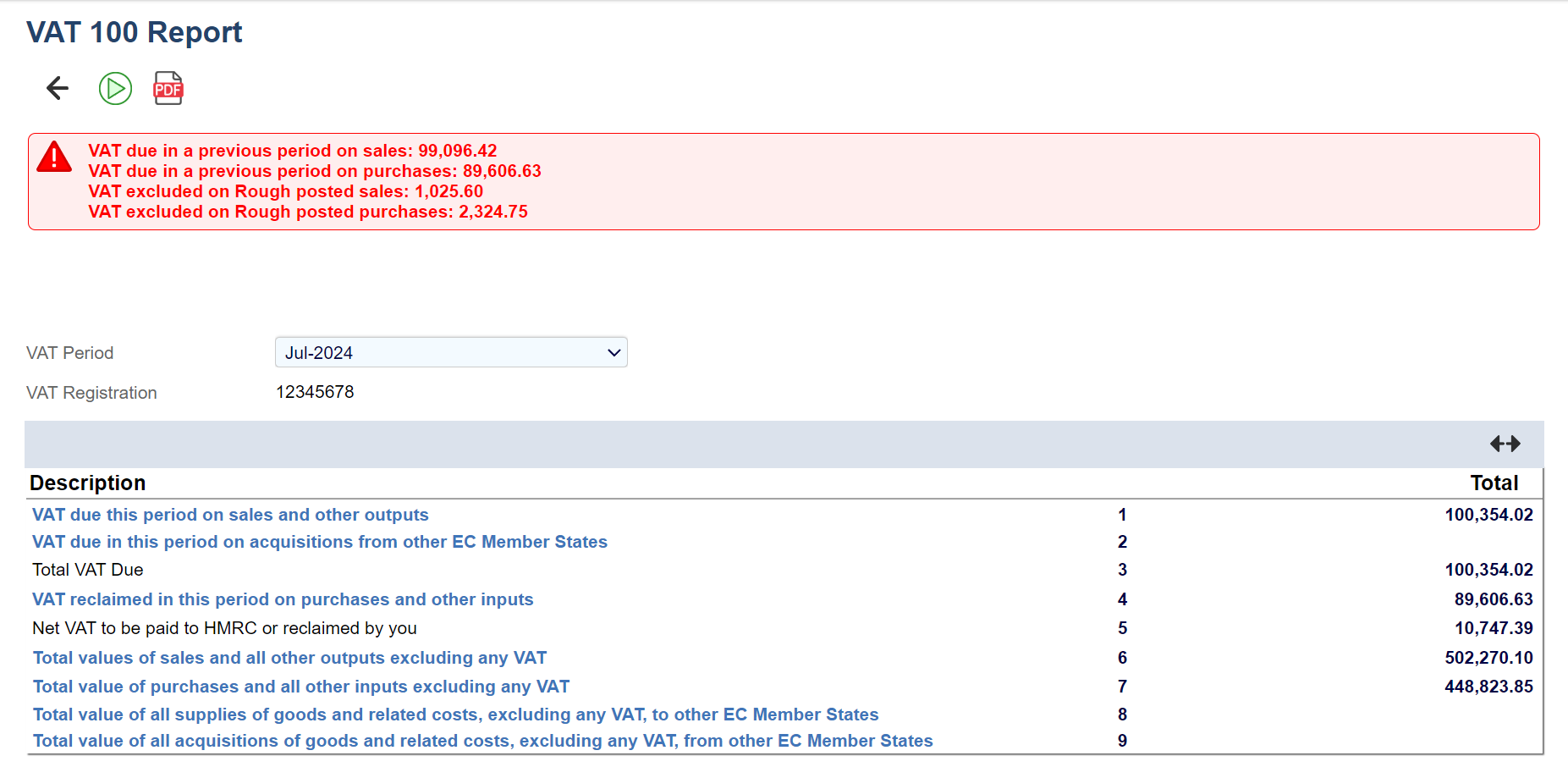

The VAT 100 Report is displayed as follows when you click the Run icon:

Please note that you may see one or more warnings at the top of the VAT 100 report. This is to let you know that something might not be correct with the VAT report.

Note that error messages and warnings are displayed in red at the top of the report.

The columns shown on the screenshot are used as follows:

Field | Description |

|---|---|

Description | Per HMRC standard; click to see transactions making up Total displayed in Enquiries > VAT Detail Enquiry. |

Numeral | Per HMRC standard. |

Total | The amount to be transcribed to the HMRC return. |

WRT Expense Claims, the VAT 100 Report includes expenses using the Period Ending date entered in the claim header even if individual expense lines cover earlier VAT periods. For example if an expense claim with a Period Ending date of 31 March contains transactions relating to January, February, and March and the VAT Period is February, all these expenses will be included in the next VAT 100 Report for May although some of the individual expenses are dated in January and February.

The totals displayed are for information only until the VAT 100 Report is processed by clicking this button at the foot of the report:

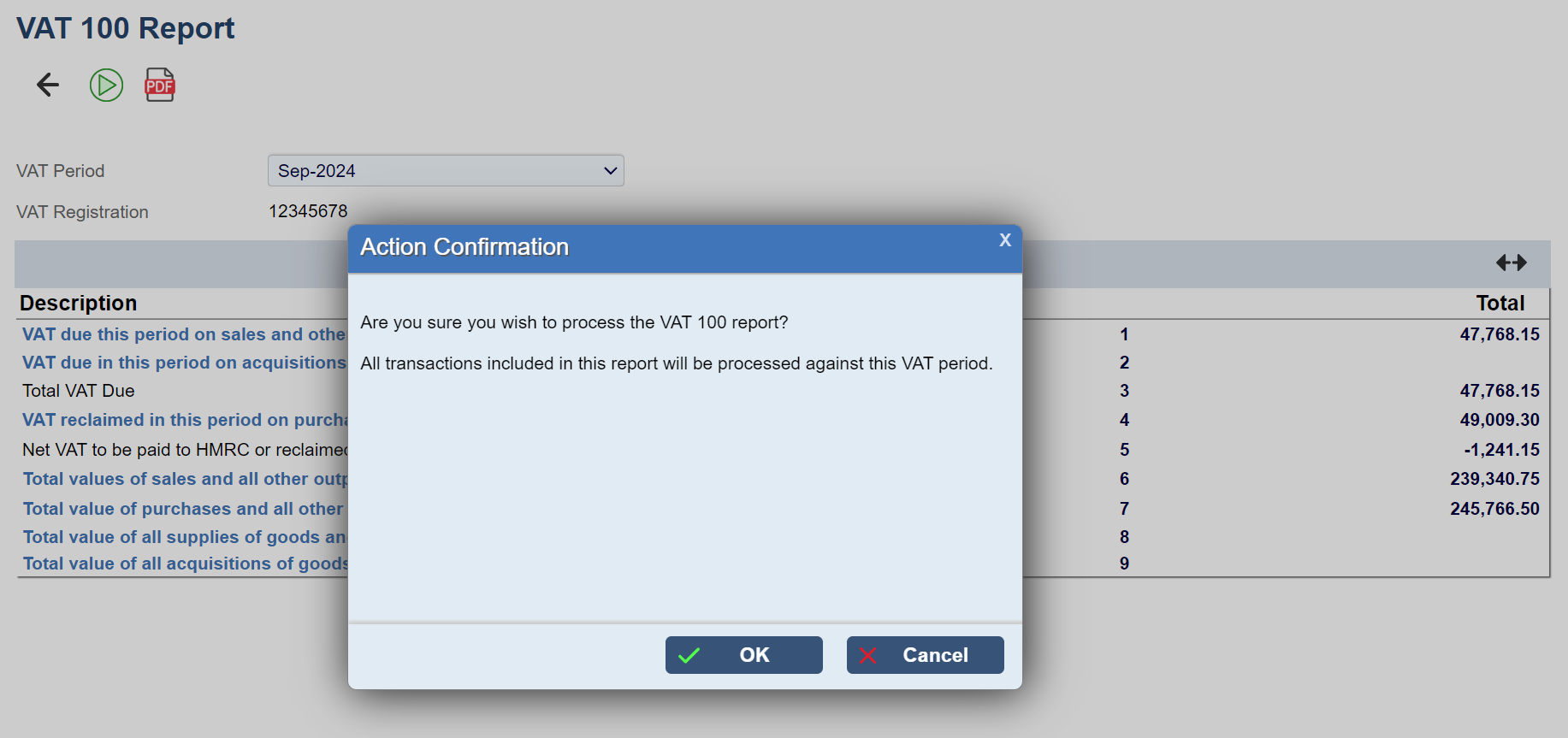

When you click Process you will be asked to confirm this action:

Before you confirm that you wish to process the VAT 100 Report check all details carefully. Any transaction that should have been included in a previous return is shown in red at Enquiries > VAT Detail Enquiry. There, you can also filter on rough posted transactions that would be included on this return were they to be posted. You cannot reverse processing a VAT 100 Report.

When you confirm Process the system will mark all the transactions selected as part of this VAT 100 Report with the run date of the report. This 'date stamp' prevents these transactions from being selected again in any future VAT 100 Reports.

The Process button will automatically convert to an HMRC button which will take you directly to the HMRC website where you can submit your VAT 100 Report.

This report can be rerun at any time with the same VAT Period Ending Date with the only difference being that the Process button will not be available. Late payments that have missed this run will be shown in red (as a total at the top) in any re-run and be automatically included in the next VAT 100 Report proper.

Process does not automatically generate a journal to reflect the amount reported to the HMRC. A manual process is required to complete this action, normally through posting the total of the Input and Output VAT accounts into a VAT control account using a Miscellaneous document.

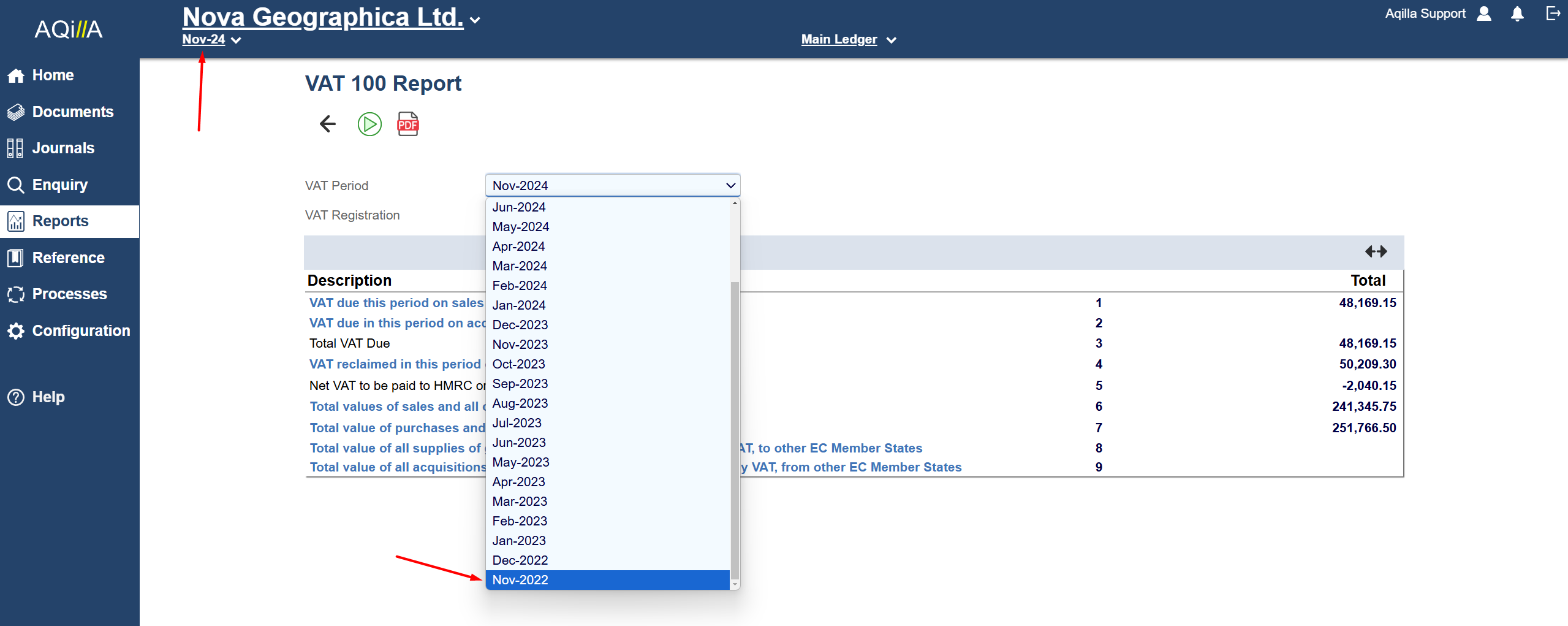

Note that you can only access VAT 100 reports that are dated within two years of the current period.

This does not mean that VAT reports that are over 2 years old are not available, but you need to change the period in the top menu to a more appropriate date to see them.

Note that you may need to change a period from Hidden to Report at Periods to be able to select it.