Fixed Asset Depreciation Document (FADD)

Fixed Asset Depreciation Documents are used to post depreciation to the ledger. This can be used to manually enter depreciation for one or more periods. Alternatively, the system will automatically generate an FADD by completing a Fixed Asset Depreciation Run (FADR), which will create a FADD which may be adjusted or posted to the ledger.

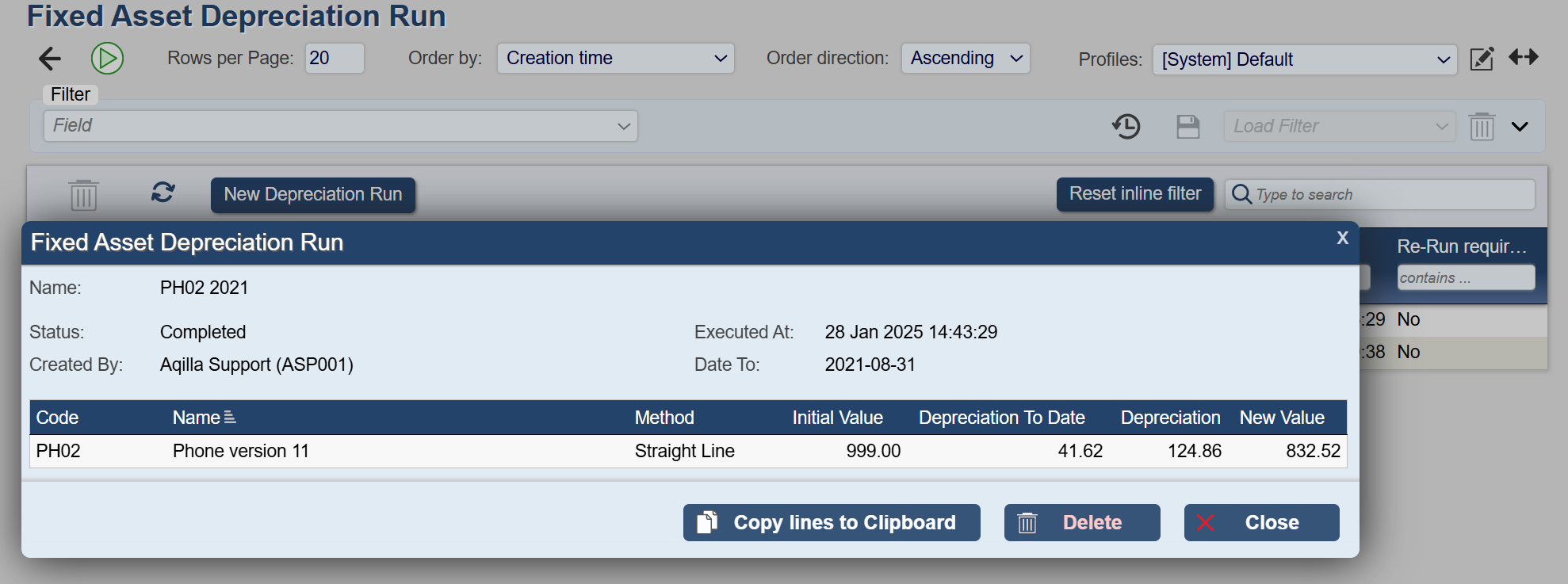

The process initiates from the Fixed Asset Depreciation Run (FADR)

Automatic creation of Fixed Asset Depreciation Document (FADD)

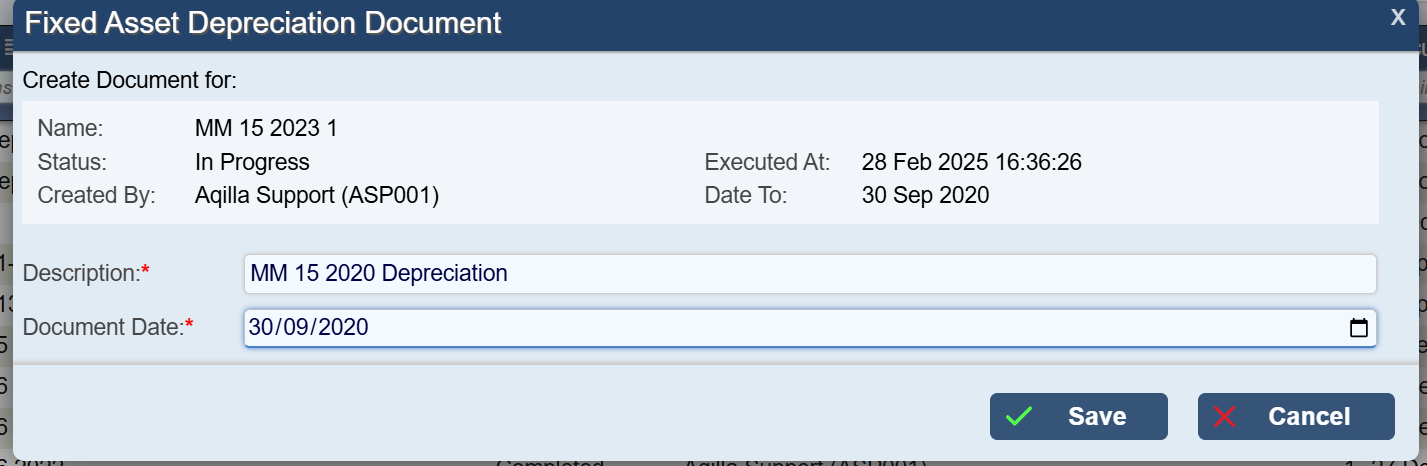

Click '+' Create Document.

You will then need to complete the following fields:

Description - A description for the document, defaulting to the FADR Name. A useful example might be "Computer Equipment FY 2023/24".

Document Date - A date for this FADD.

On completion, click 'Save' to create a new Fixed Asset Depreciation Document.

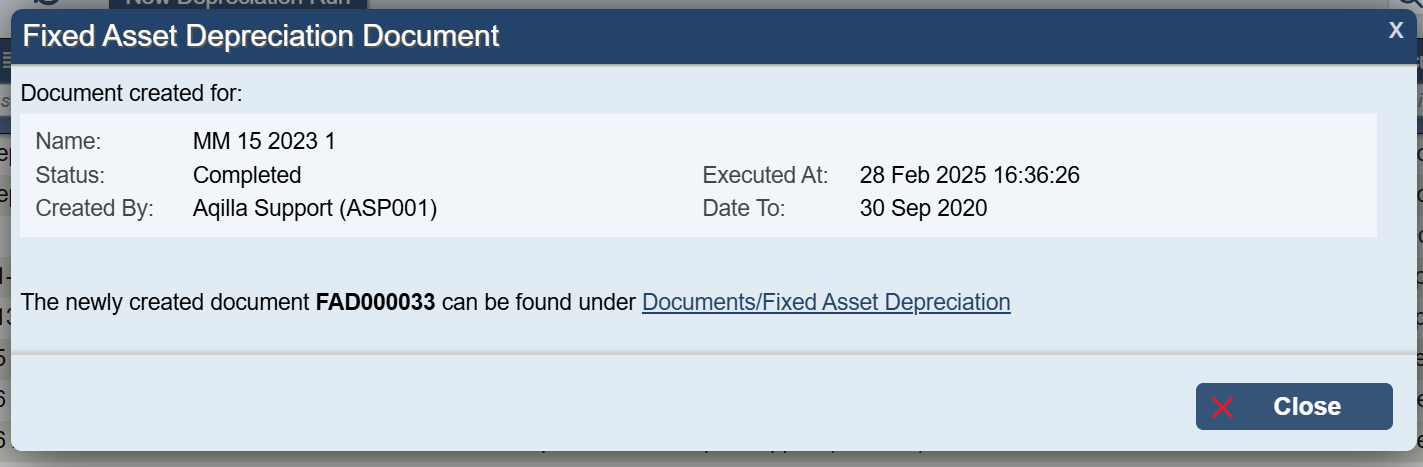

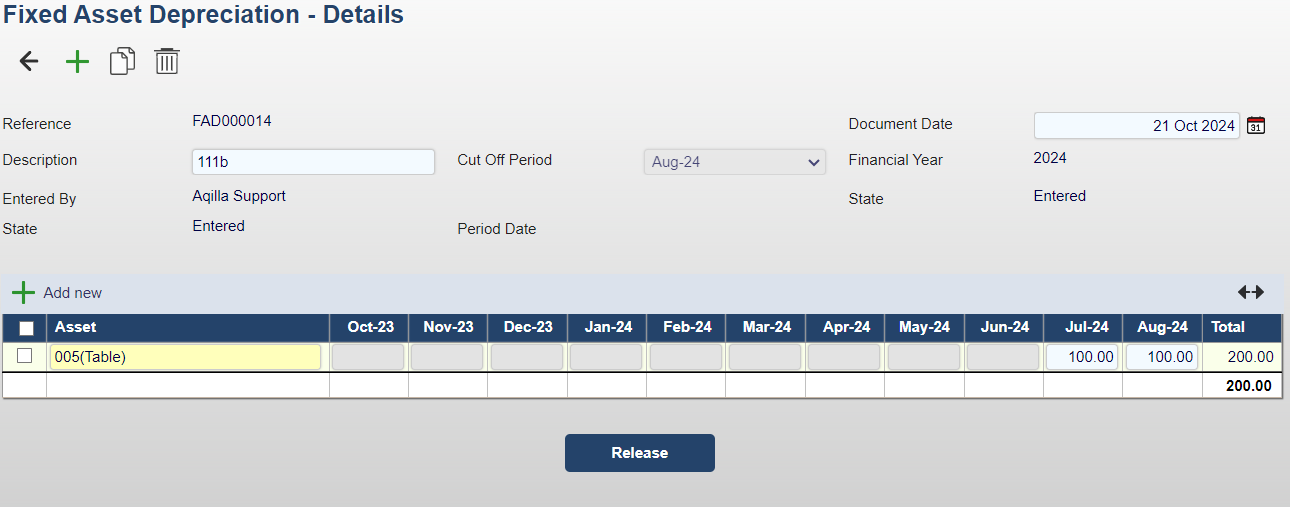

The FADD that is created will automatically be given the next available document reference (e.g. FAD000012).

A link will also be created that will take you directly to the FADD in Documents > Fixed Asset Depreciation Document.

Click on the link which will navigate you to Documents >Miscellaneous >> Fixed Asset Depreciation Document.

The FADD is initially generated based upon the parameters provided during the depreciation run. However, it can still be edited. For example, it is possible to change the depreciation value(s) in one or more Financial Periods.

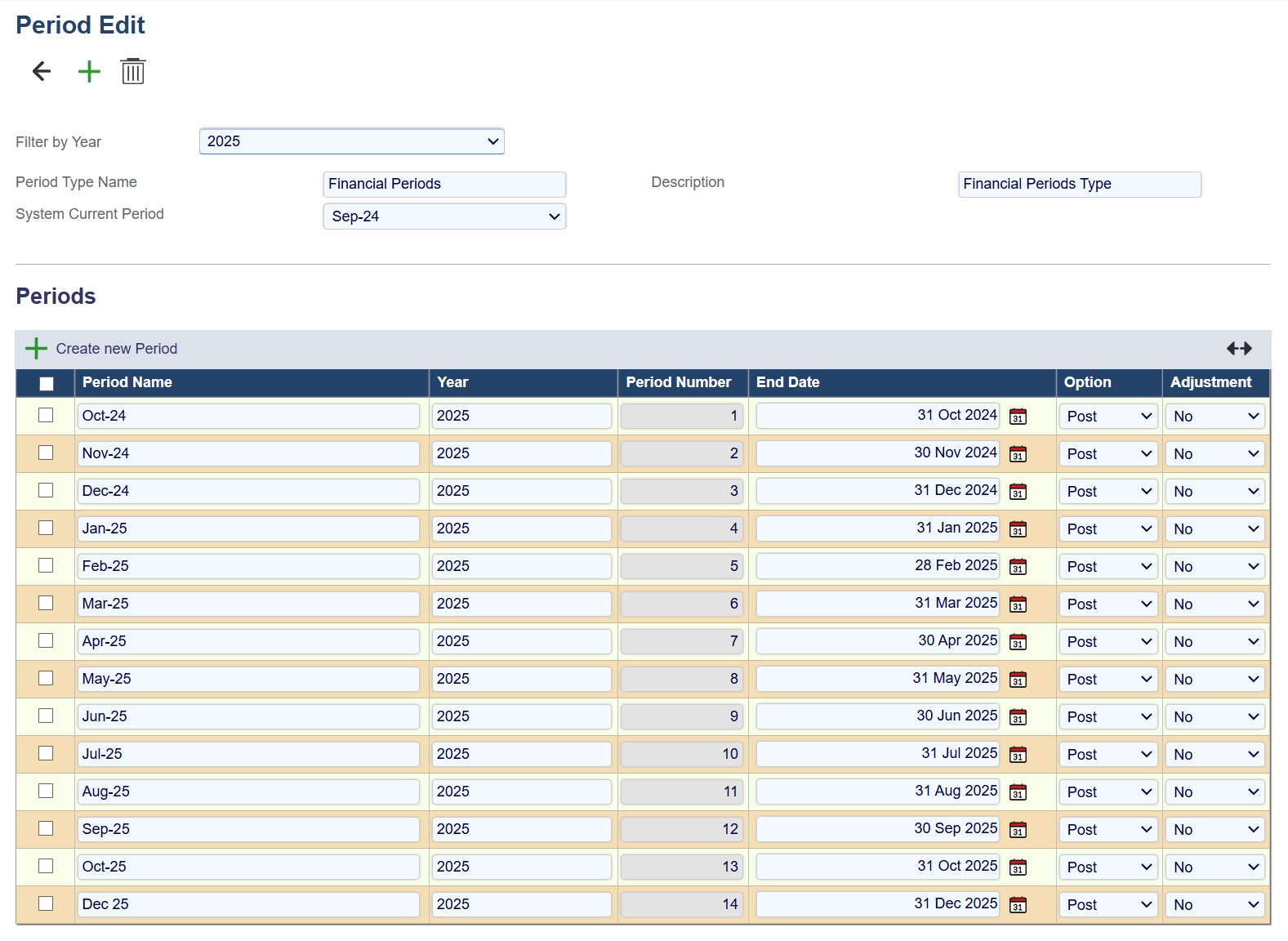

The system will automatically distribute the calculated depreciation value across non-adjustment periods. Adjustment periods will not be displayed, and closed periods will be locked for editing, indicated by grey shading. Depreciation values cannot be entered into closed periods; however, you can adjust the depreciation values within open periods as needed.

More information on how to create the FADD document via FADR can be found at: Fixed Asset Depreciation Run (FADR)

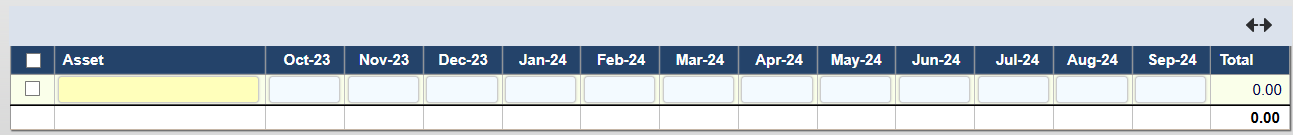

Creating a FADD manually

The FADD may also be used to post depreciation to assets manually

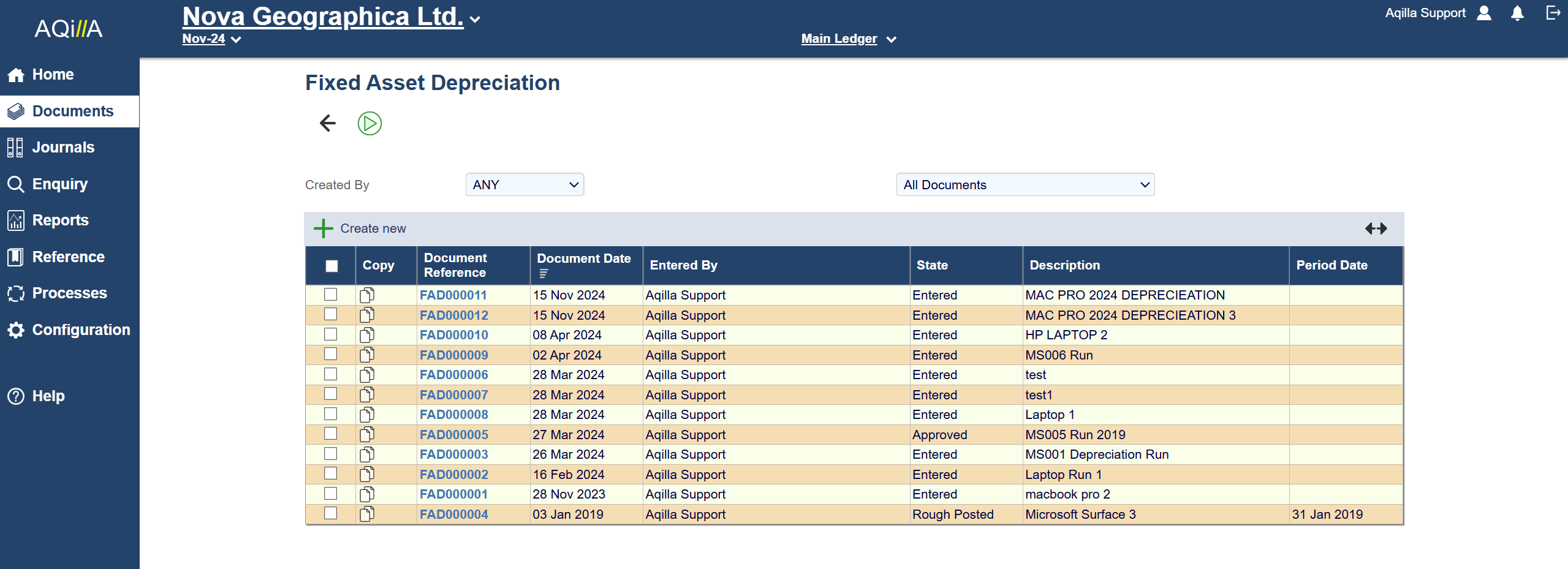

Go to Documents >> Miscellaneous >> Fixed Asset Depreciation

Click '+' Create New

Enter the following information: he document.

Description - A meaningful name for this Fixed Asset Depreciation Document (e.g. Computer Equipment 2023)

Cut Off Period - The Financial Period to post depreciation up to.

Document Date - The date that will appear on the ledger.

Asset(s) - the chosen assets for this document, one per line. The assets must already exist in the Fixed Asset Register (FAR) in order to be selectable.

Click Save

Select an Asset (double-click, this will display a list from the Fixed Assets Register)

Enter a depreciation value in the relevant period(s)

Click Save

The total will be calculated and the document will now follow the relevant workflow setup in your system.

How to Amend Financial Periods

This can be configured in:

Configuration > Periods > Financial Periods

Workflow

The Fixed Asset Depreciation Document follows the standard Aqilla Budget Workflow:

Enter (i.e. Create)

Release

Approve (or Reject)

Post (or Rough Post)

This Workflow can be changed, or a separate new Workflow created, if required. Please speak to Support or your Consultant.