Fixed Asset Depreciation Run (FADR)

Introduction to Fixed Asset Depreciation Run

A Fixed Asset Depreciation Run (also referred to as an FADR) is a process that calculates depreciation for a selection of Fixed Assets chosen from the Fixed Asset Register.

The Depreciation calculated by the FADR is based on the parameters recorded in the Fixed Asset record (in the Fixed Asset Register).

These parameters include:

The Depreciation Accounts (both Balance Sheet and Profit & Loss) to be used when posting

Whether the asset is Disabled for depreciation (if so, it will be excluded)

The Depreciation Basis (Cost, or Cost less Residual Value) and Depreciation Method

The Lifespan of the asset (determined by the number of depreciation periods from the asset start date)

Only Fixed Assets that can be depreciated are available to be included in a Fixed Asset Depreciation Run.

How to Calculate Depreciation

There are two options available to initiate a depreciation run

Go to References > Fixed Assets Register:

Select the Fixed Assets to be included in this run

Click

to calculate the depreciation for the selected assets

to calculate the depreciation for the selected assets

Alternatively,

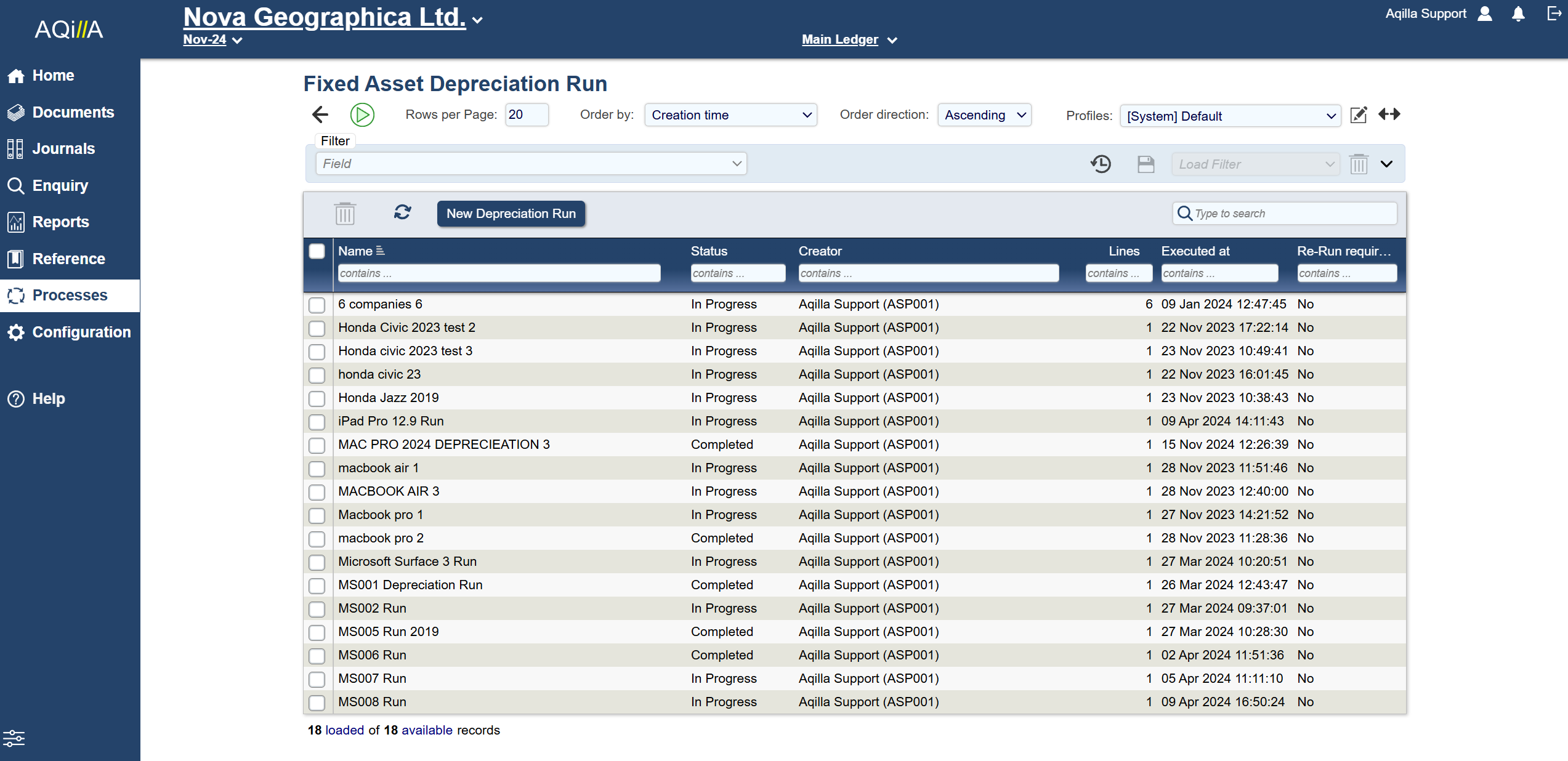

Go to Processes > Fixed Asset Depreciation Run

Create a new Fixed Asset Depreciation Run

Select relevant Assets

Calculate the Depreciation for those Fixed Assets

The Selection step allows Fixed Assets to be grouped together into a single run. Multiple runs (representing multiple groupings) may be created and at any point.

The Calculation step "locks" the Fixed Assets that are included in each run. This helps to prevent individual Fixed Assets from being accidentally included in multiple runs.

Once the process has been completed, proceeding with further steps (or deleting the result) will "unlock" the locked Fixed Assets.

Calculating Depreciation

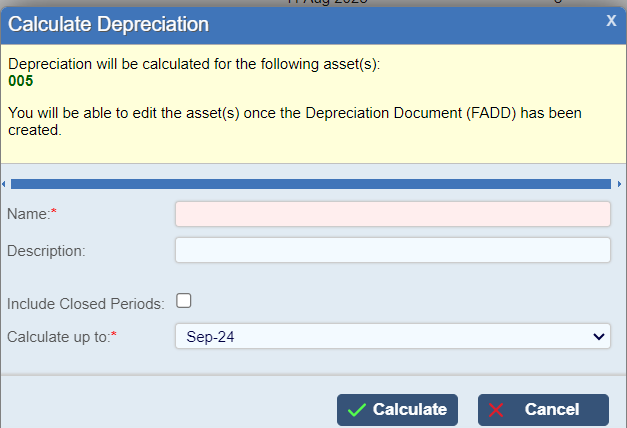

When creating a New Depreciation Run, details are entered into a popup window.

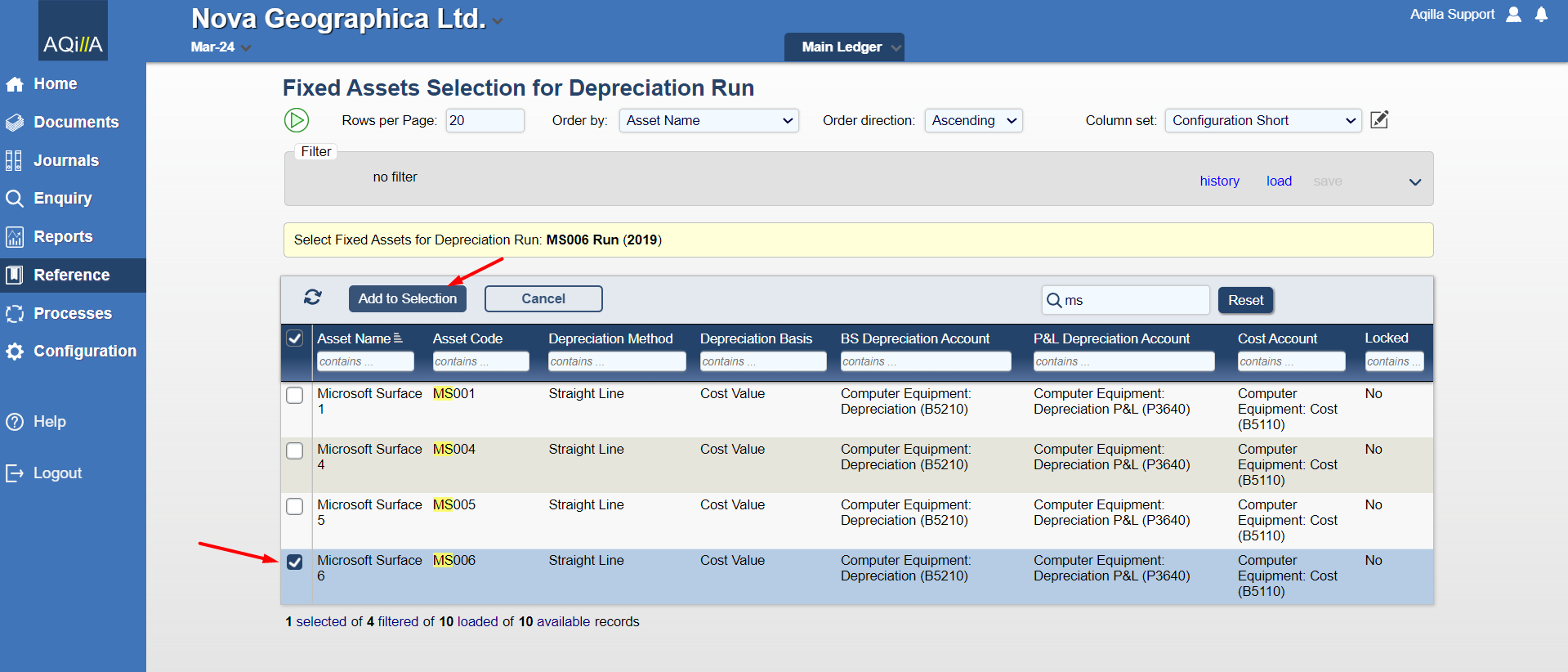

If you initiated the process via Process < Fixed Asset Depreciation Run, then the next step is to select the Fixed Assets that should be included in this FADR.

Clicking on "Select Fixed Assets" will direct the user to a screen headed "Fixed Assets Selection for Depreciation Run".

This screen has two sections:

A top section where Filters can be used to help find the correct Fixed Assets to be included in the run

A bottom section where Fixed Assets are offered for selection and can be chosen by ticking a selection box

When the required assets have been selected, click on the "Add to Selection" button, this will bring up a popup window also labelled "Add to Selection".

If all assets have been correctly chosen for this Depreciation Run, then please click "Finish and Return". Otherwise click "Close" and continue selecting assets to be depreciated.

Basic details of the run will need to be filled in:

Name - Enter a meaningful name for this depreciation run

Description - An optional area to add further details

Calculate up to - Select the period you wish to calculate depreciation up to.

Depreciation is calculated from the last depreciation date, or the asset’s start date to the end of the selected period. Mid-month start dates are calculated from the end of the period based on the asset’s start date.

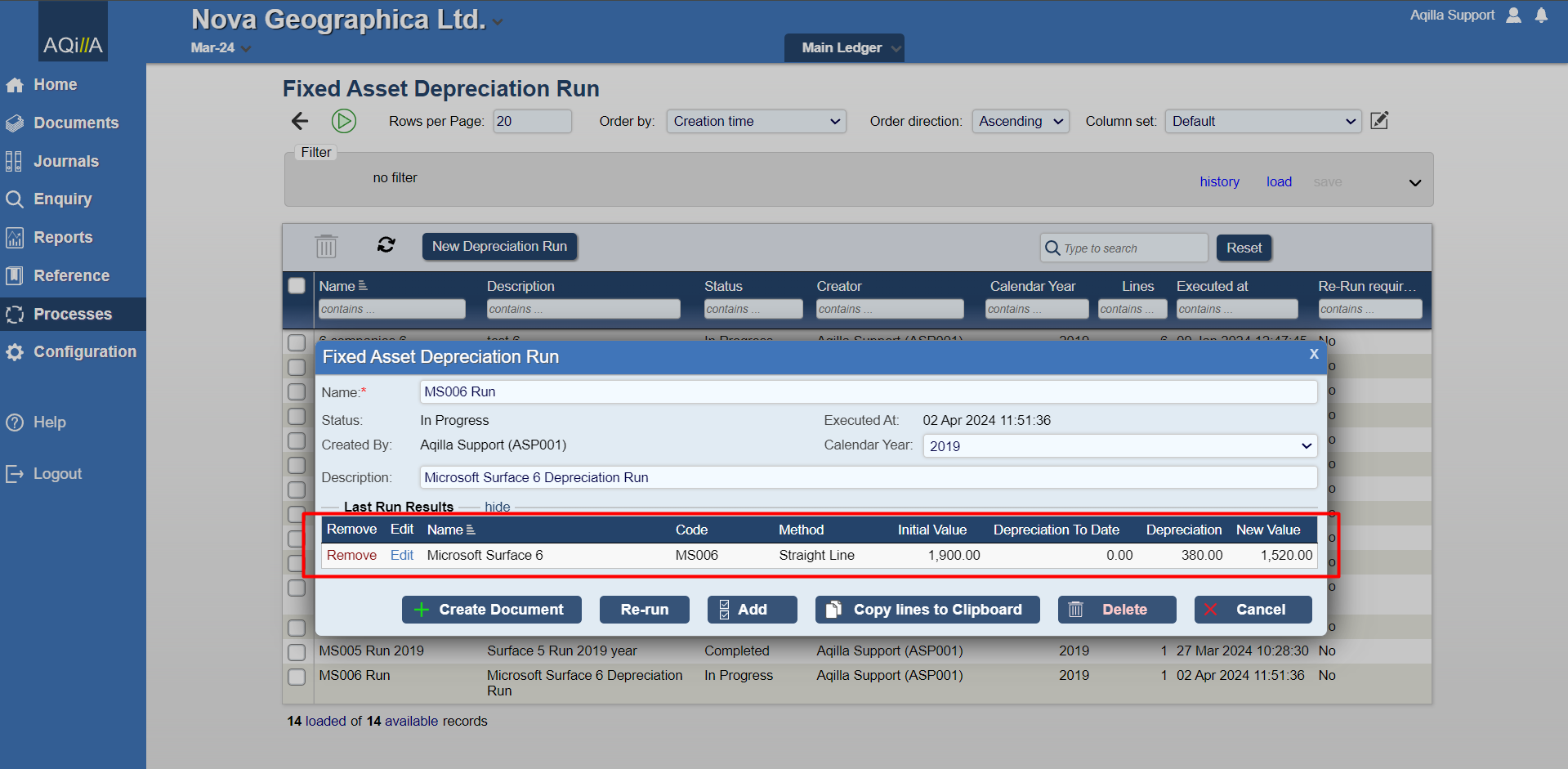

Once the Fixed Asset Depreciation Run has completed, a pop up will display a summary for each asset included in the run.

Name

Code

Method

Initial Value - The sum of postings to the Cost Account in the Balance Sheet

Depreciation to Date - The sum of postings to the Depreciation Account in the Balance Sheet, before this FADR

Depreciation - As calculated in this FADR

New Value - The Net Book Value after this FADR (i.e. assuming that the calculated depreciation will be Posted - see Fixed Asset Depreciation (FADD))

This view is slightly revised if there is an issue with the calculated depreciation: i.e. the expected depreciation differs from the accumulated depreciation to date.

Expected Accumulated Depreciation - The system will display the expected accumulated depreciation based on the asset’s cost value.

Problems - Error messages to show any problems with this FADR. See the next section, below, for examples

There are then options to:

Create Document: Creates a Fixed Asset Depreciation Document to post depreciation to the ledger.

Re-run: Repeats this Fixed Asset Depreciation Run (used if amendments are required, or if initial run failed).

Add: To Add (or Remove) Fixed Assets from this Fixed Asset Depreciation Run.

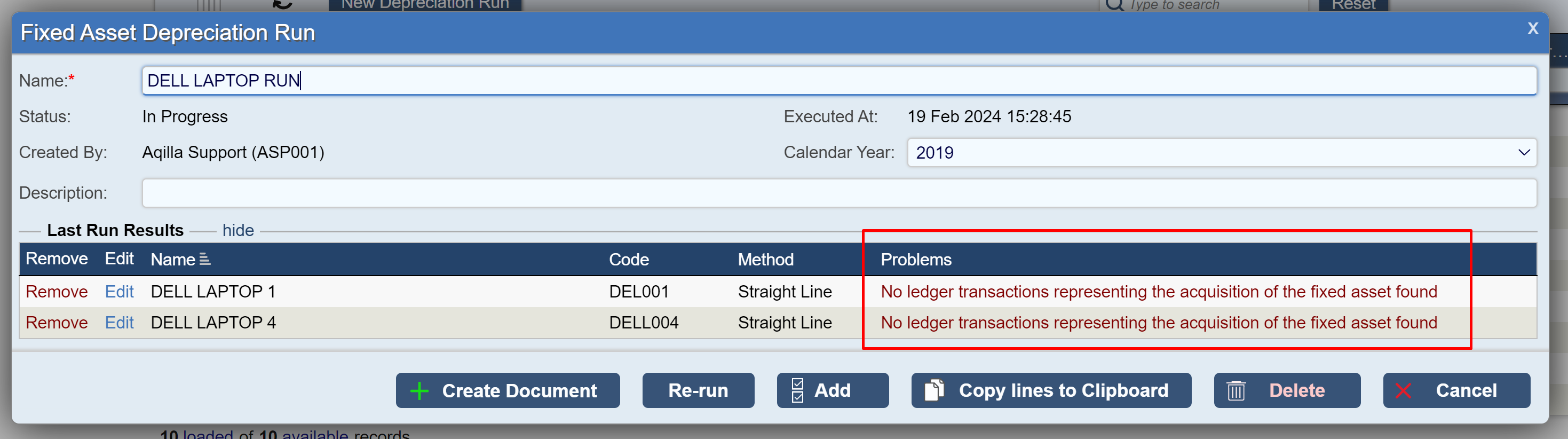

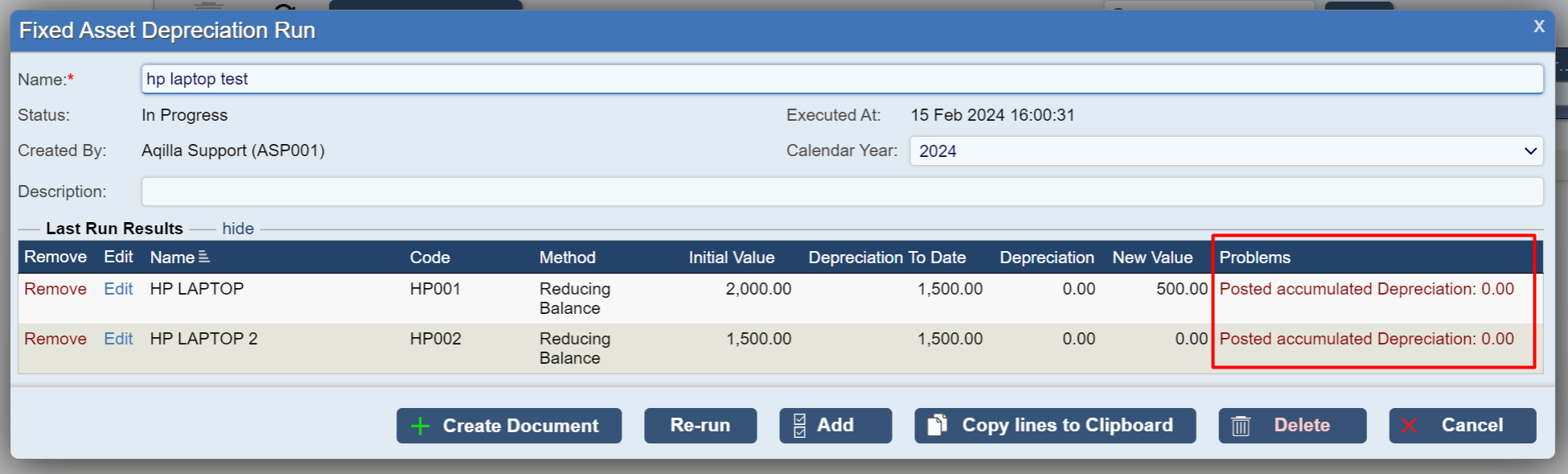

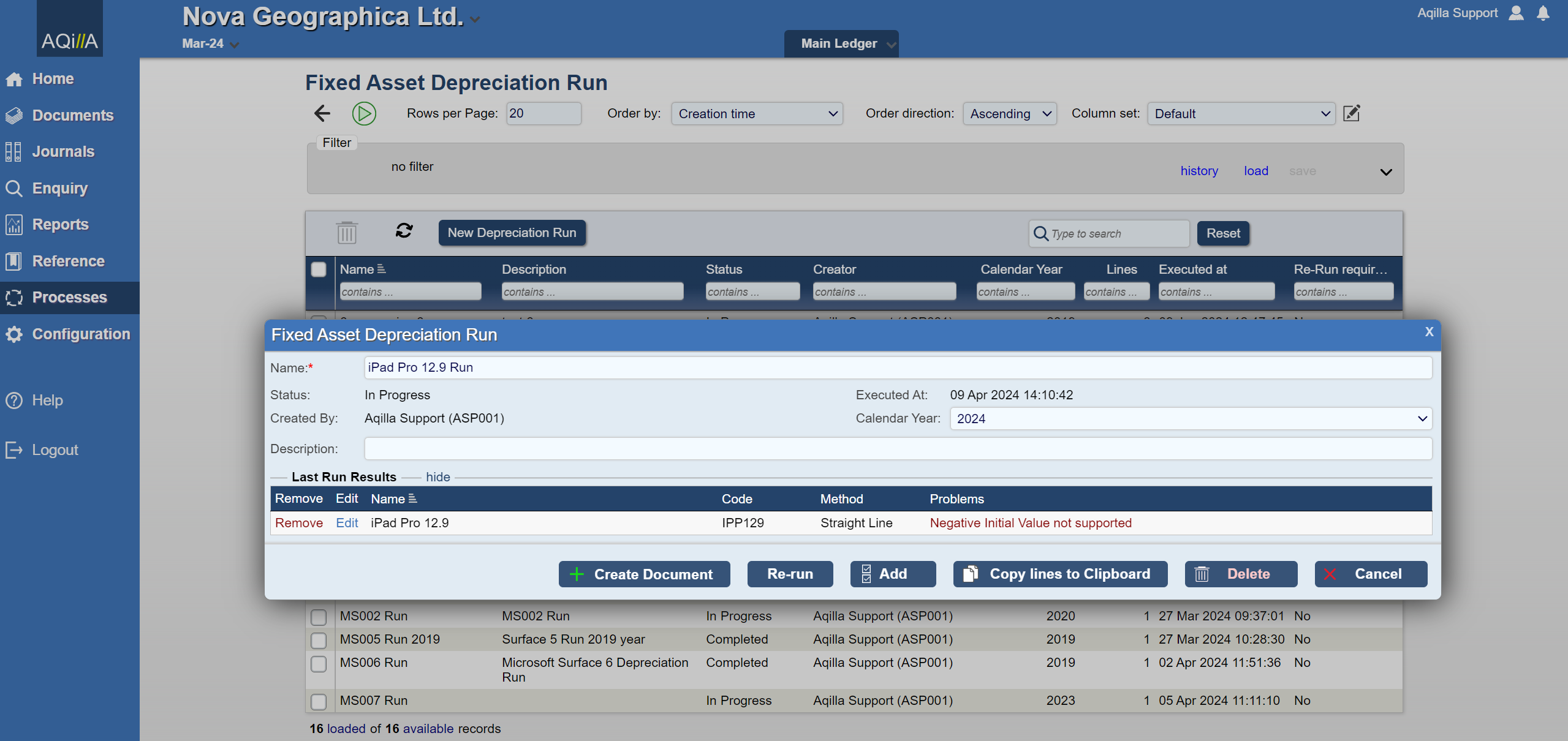

Error Messages and Warnings

You may see these error messages whilst using Fixed Asset Depreciation Run (FADR).

Error | Troubleshooting/Solution |

|---|---|

'No Ledger transactions representing the acquisition of the fixed asset found'  | This error occurs when no Cost Value is found for the Fixed Asset. Depreciation cannot be calculated for the Fixed Asset because no Cost Value has yet been posted for the Fixed Asset. To resolve this issue, create a Purchase Invoice or Miscellaneous Document to assign the Fixed Asset. This will post a Cost Value to the Fixed Asset Cost Account and designate the specific Fixed Asset that has been purchased. See Purchase Invoices or Miscellaneous Documents. |

'Posted Accumulated Depreciation: 0.00'  | If there should be accumulated depreciation from previous years, because the Fixed Asset was purchased some time ago, but no accumulated depreciation can be found, then it will not be possible to correctly calculate the current depreciation until the previous depreciation has been calculated and posted. |

‘Negative Initial Value not supported’  | This is an error that may occur if the Fixed Asset cost was posted incorrectly. It suggests that the Fixed Asset cost has been posted to the designated Balance Sheet Cost Account as a Credit (it should be a Debit). Please check the appropriate document and correct any incorrect postings. |