Making Tax Digital

Making Tax Digital

1. Introduction & High Level Summary

Aqilla Ltd does not provide tax advice. Please consult with HMRC and/or your advisors about your organisation's tax obligations.

HMRC has published VAT Notice 700/22: Making Tax Digital for VAT and the policy paper Overview of Making Tax Digital. Also see Making Tax Digital for VAT.

Making Tax Digital (MTD) for VAT requires VAT registered businesses with taxable turnover above the VAT registration threshold to keep records in digital form and file their VAT Returns using software - specifically communicating with HMRC digitally via its Application Programming Interface (API) platform (rather than entering data into HMRC's existing VAT online services).

Unless you meet HMRC's criteria for deferral, the Making Tax Digital rules apply from your first VAT period starting on or after 01 April 2019. A ‘VAT period’ is the inclusive dates covered by your VAT Return. If you qualify for deferral the rules apply from 01 October 2019.

Aqilla is recognised by HMRC as being ready and available to support Making Tax Digital. See HRMC's list of VAT compatible software - available now. Aqilla's entry at HMRC's site covers all areas specified by HMRC:

Digital Record Keeping

Submit VAT Return

View VAT Return

View VAT Liabilities

View VAT Payments

This functionality was released (with restricted access) in Aqilla version 1811 (Nov 2018) for final testing with HMRC. Aqilla version 1903 (Mar 2019) made this functionality available to all Aqilla users. Aqilla version 1910 (Oct 2019) introduces support for VAT Groups to report using MTD.

When you have enabled MTD Reports > VAT 100 Report becomes a tool for accessing historic data.

2. Initial Setup

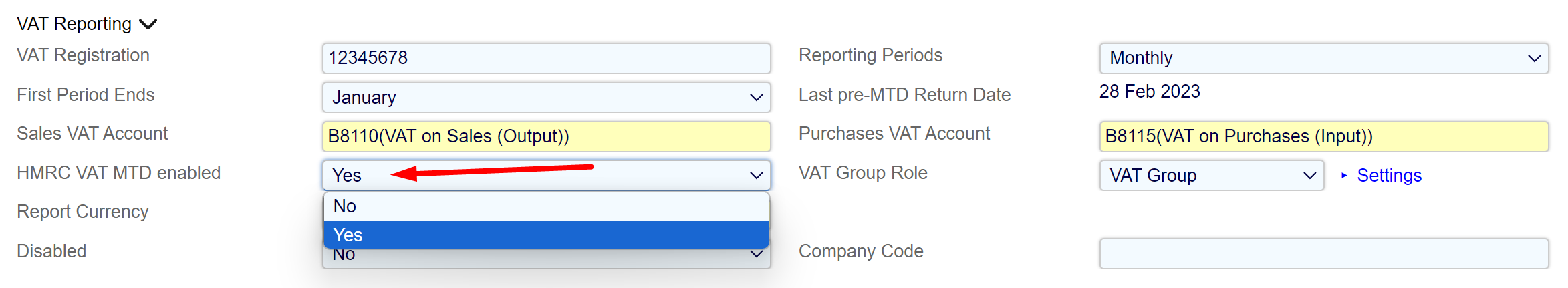

Go to Configuration > Companies and enter your VAT registration number and enable HMRC VAT MTD:

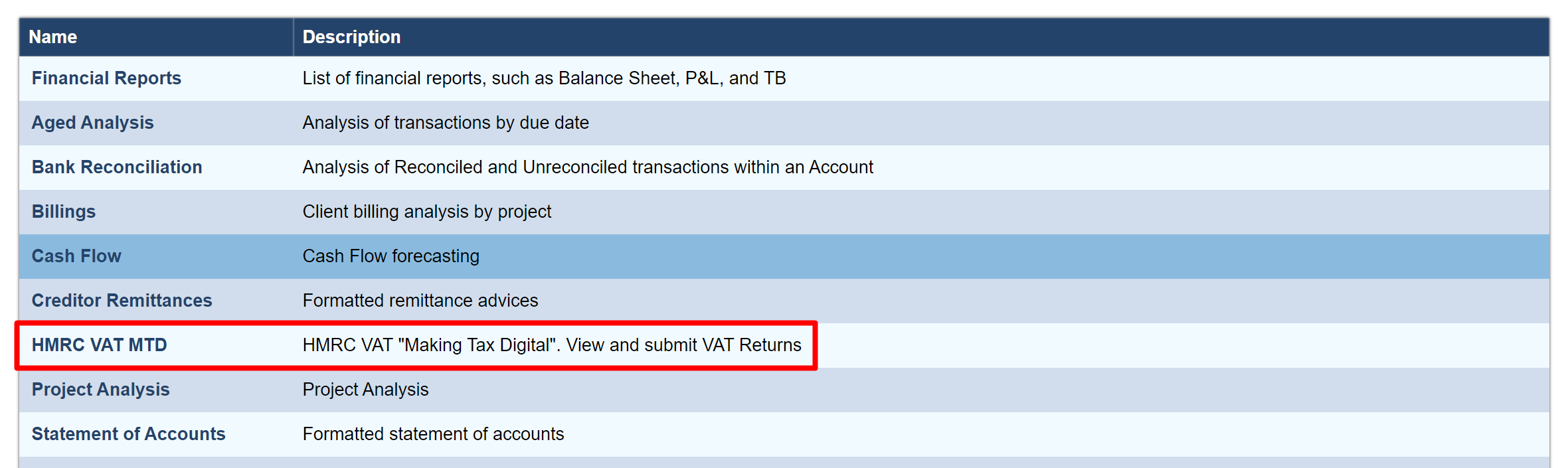

A new report will become available:

A new report will become available:

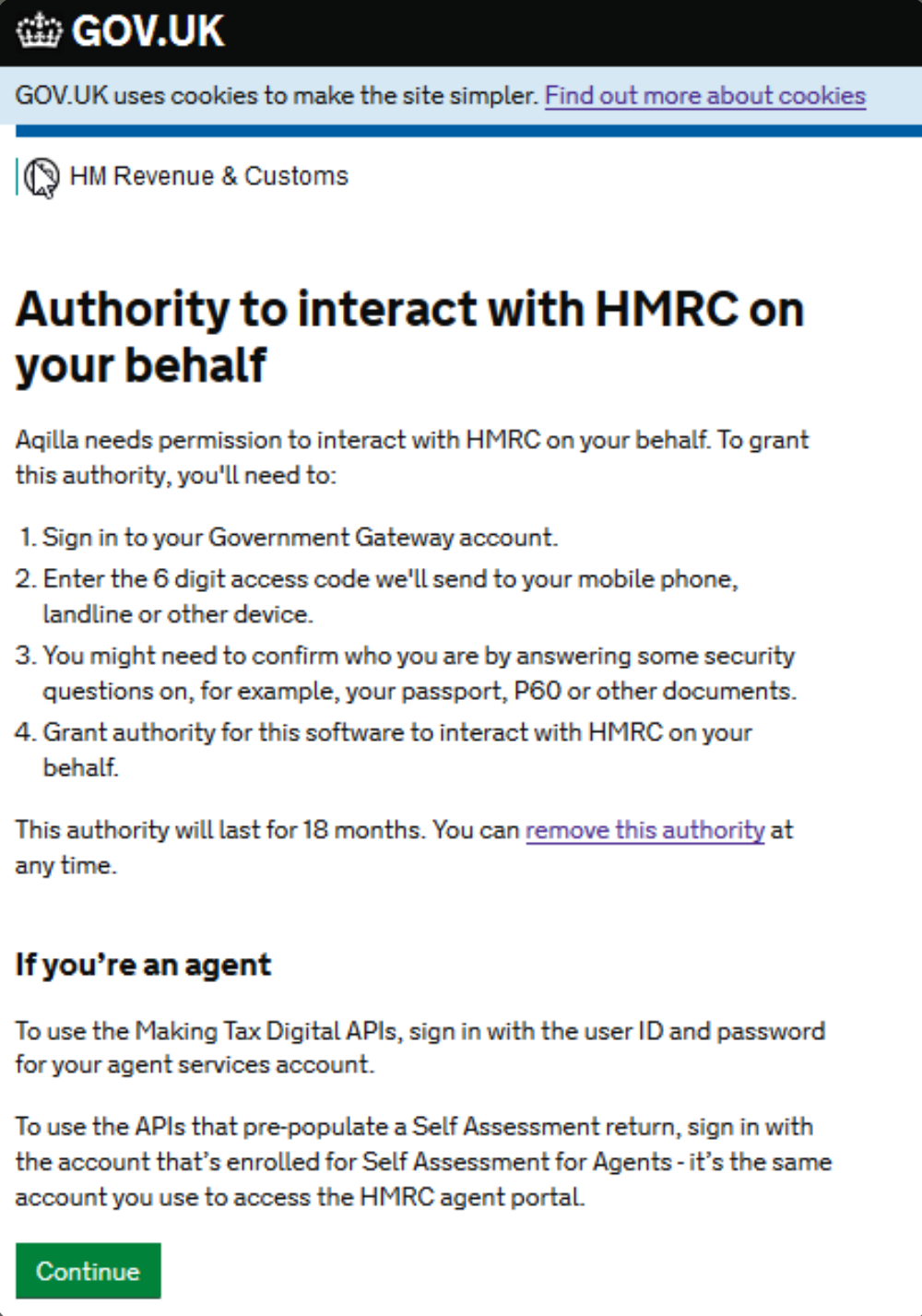

The first time you run this report you will be directed to HMRC's website and see this message:

You will then be required to enter your Government Gateway credentials.

Follow HMRC's instructions after you have submitted your credentials.

When you are using a http://gov.uk/ branded pop-up window you are using HMRC's website and not Aqilla. Aqilla is unable to help you with any issues you may have whilst using such pages.

Some browsers may not provide vertical scroll bars on HMRC pages. If you find this is the case you should zoom out using your browser's functionality.

3. HMRC VAT MTD

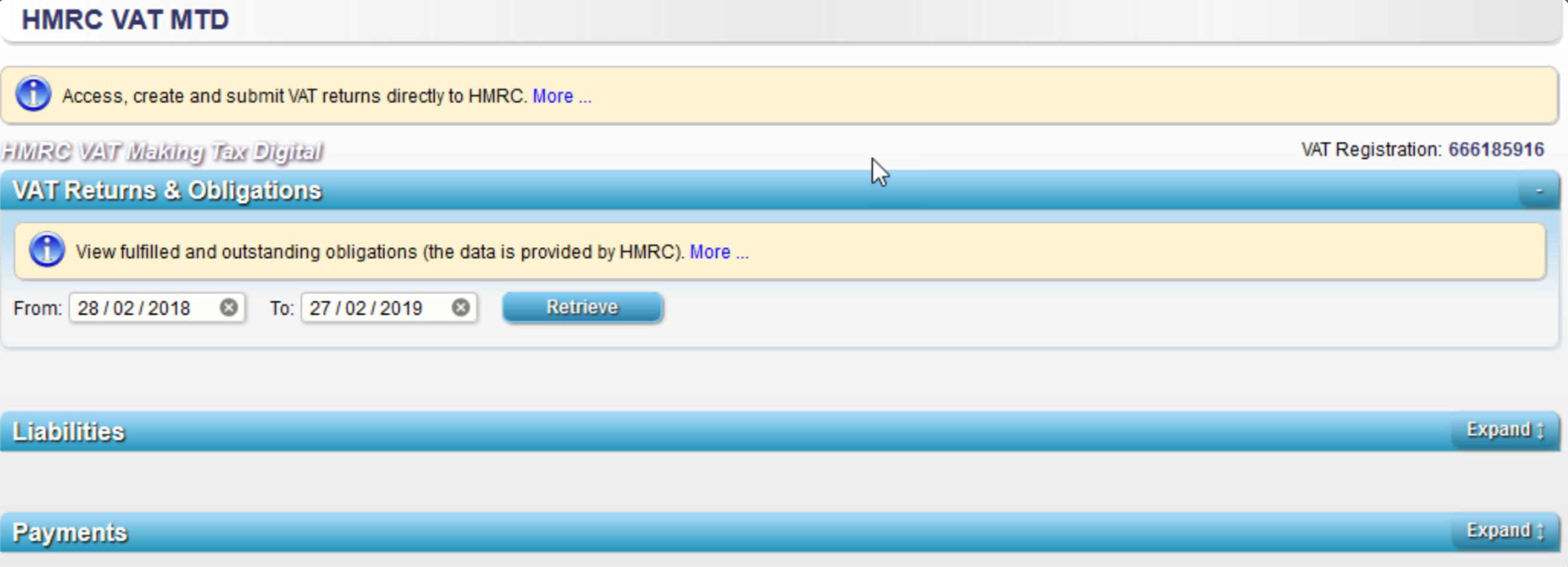

Once you have been authenticated, you will then (and subsequently on selecting Reports > HMRC VAT MTD) be taken to this page:

You can expand and contract each section. You can also hide and show the embedded help by clicking on the information and help icons and More and Less.

3.1 VAT Returns & Obligations

This section is used to view fullfilled and outstanding obligations based on data held by HMRC. HMRC intend to create a new obligation on the first day of each new period. It is also used to create a new VAT return and then submit it to HMRC. You can view (but not edit) a fullfilled obligation (i.e. a VAT return). You can create and save a new VAT return and submit it to HMRC. You can delete a new VAT return that has not already been submitted to HMRC. See further details at 4. Submitting a VAT Return (below).

Your VAT obligations to HMRC may not be updated as soon as you submit a VAT return. This is outside the scope of Aqilla's control.

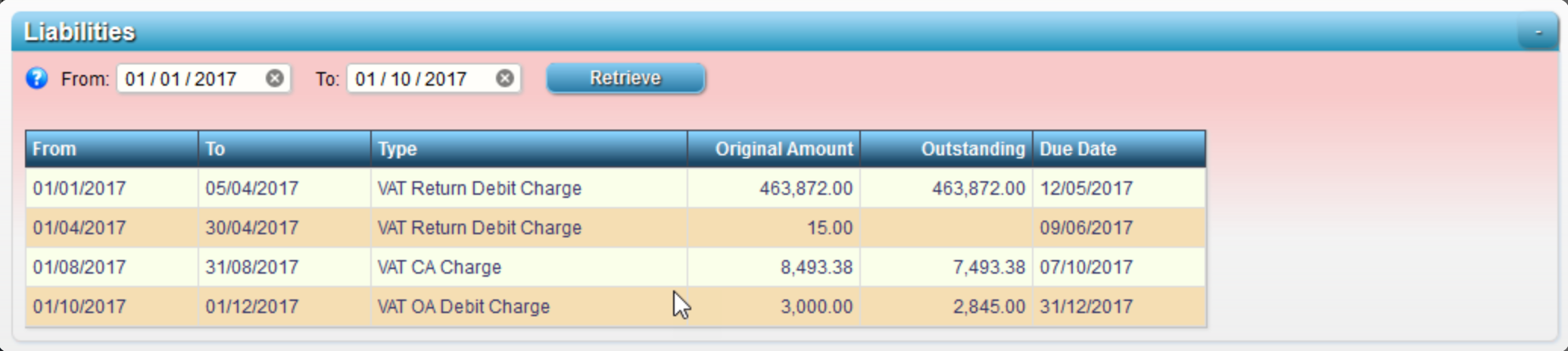

3.2 Liabilities

This section shows the history of your liabilities to HMRC based on data held by them.

Your liabilities to HMRC may not be updated as soon as you submit a VAT return. This is outside the scope of Aqilla's control.

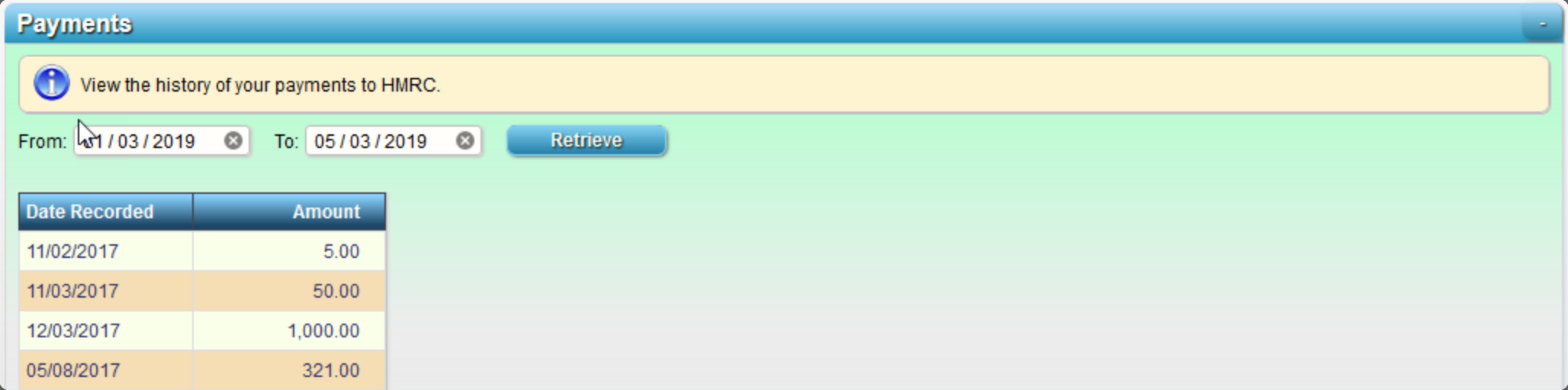

3.3 Payments

This section shows the history of your payments to HMRC based on data held by them.

Your payments to HMRC may not be updated as soon as you make them. This is outside the scope of Aqilla's control.

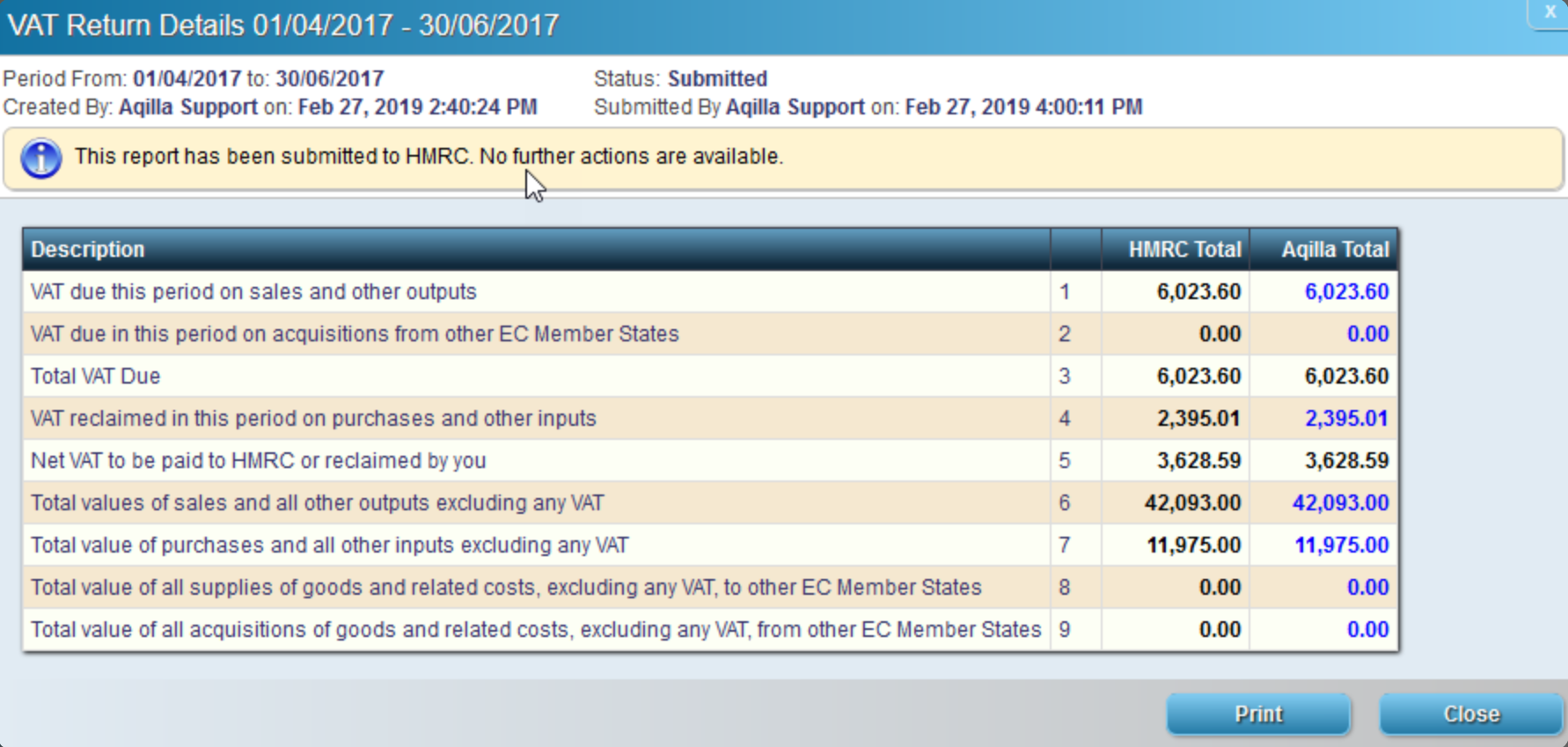

4. Viewing VAT Returns & Obligations

To view any VAT return (submitted or not) simply navigate to the return in question (see 3.1 VAT Returns & Obligations above) then click on the action View Details and this window (the example is a submitted return) will pop up:

The HMRC Total comes from HMRC. The Aqilla Total comes from Aqilla. You can drill down from the Aqilla Total to the VAT Detail Enquiry.

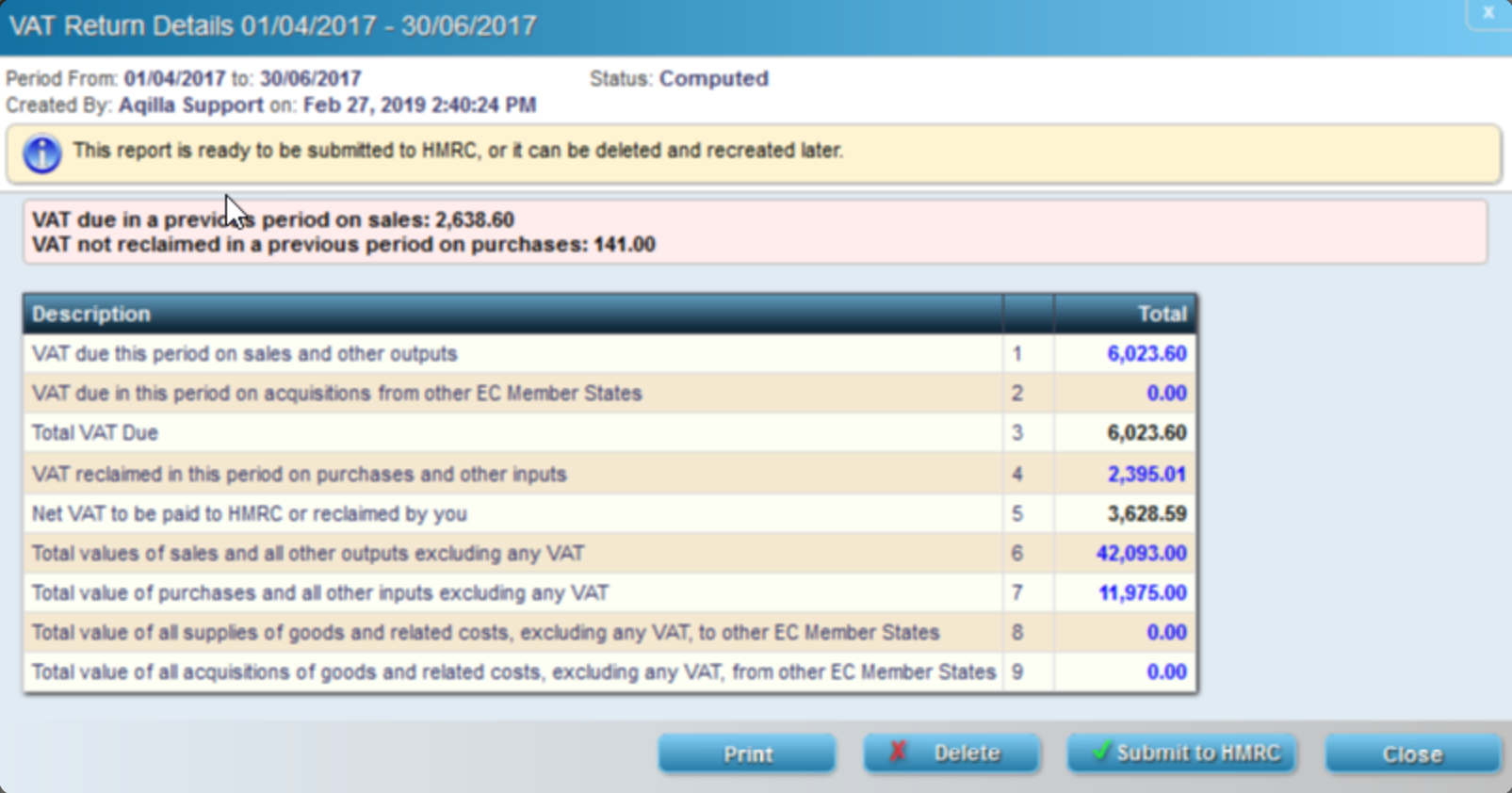

5. Submitting VAT Returns

To submit any VAT return simply navigate to the return in question (see 3.1 VAT Returns & Obligations above) then click on the action View Details and this window will pop up:

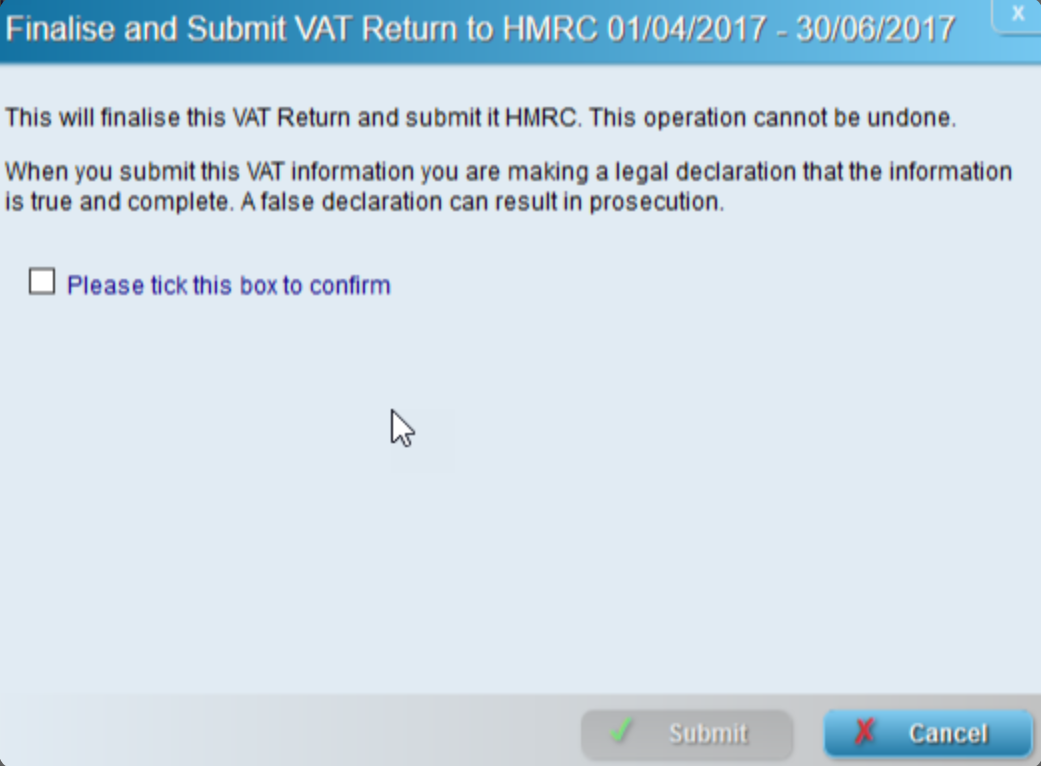

The options are self-explanatory. You will be given a "final warning" (as required by HMRC) before you click Submit.

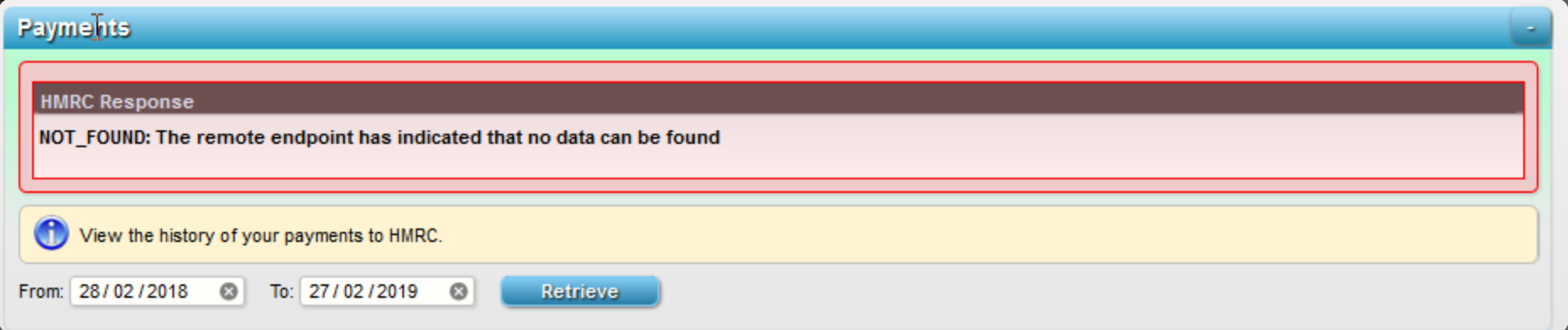

6. Error Messages

You may occasionally see an error message in this style. This error message is provided by HMRC not Aqilla. We expect that error messages will become more meaningful as the HMRC service matures.

7. MTD Date range

HMRC has recently added even more controls to the processing of Making Tax Digital submissions. To make sure continuity of operation is preserved Aqilla now supports the HMRC VAT MTD date range as per their instructions; namely that:

The date range is limited to 366 days;

The earliest possible “From” date is now effectively 1st April 2019.