VAT Detail Enquiry

VAT Detail Enquiry

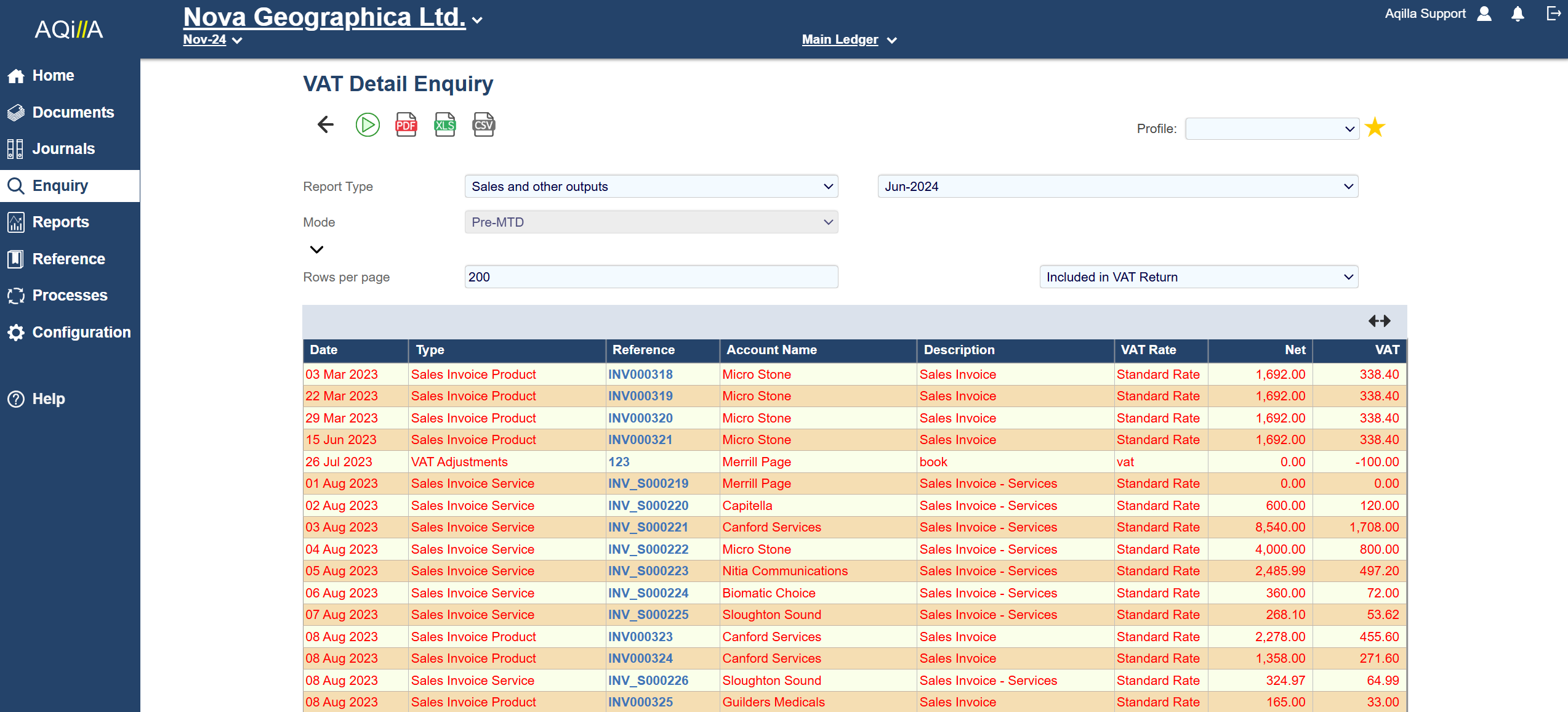

The VAT Detail Enquiry enables you to enquire on transactions that make up a VAT 100 report. You can run this enquiry from the Enquiries tab or by drilling down from Reports > VAT 100 Report.

Enquiry Options

VAT detail enquiry will show you which transactions are included in the VAT return for the selected period.

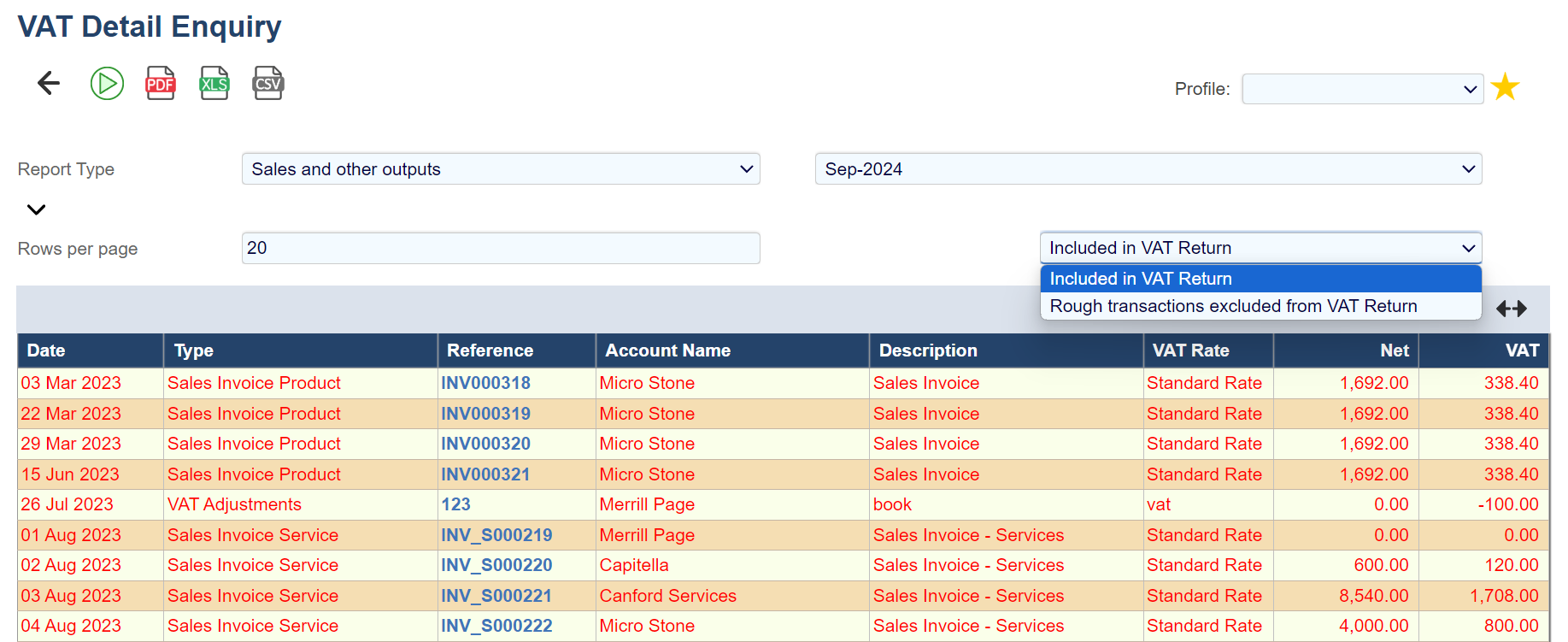

Please note that previously not submitted transactions show up in Red. This means that if you had not reported all transactions for a given period that Aqilla will make up for it and submit them on the next VAT return.

You can see how this will look on the screenshot on the right.

Please make sure you select the correct Report Type and Period in the filters when using the VAT Detail enquiry.

You have the following options:

All included transactions will be shown in a grid view. Invoices that were paid late and missed the last VAT 100 Report are shown in red.

Report Type | VAT Period | Mode | Rows per Page | |

|---|---|---|---|---|

| Self-explanatory | Pre-MTD; Post MTD | Self-explanatory | Included in VAT Return; Rough transactions excluded from VAT Return |

Reverse Charge VAT

A VAT Reverse charge is also included (if it is applicable to your business). When services are reported in the EU, the VAT on the purchase is recorded at zero rate VAT. However, the standard rate VAT should be reported in both Box 1 and Box 4 of the VAT 100 Report.

In order to support this functionality, there are various parameters that need to be set at Reference > VAT Rates.

Note: Reverse charge VAT is only for reporting purposes and is not recorded in the VAT accounts.