MTD in multi-company instances

MTD in multi-company instances

You may have multiple companies in a single instance each with a separate VRN (VAT Registration Number).

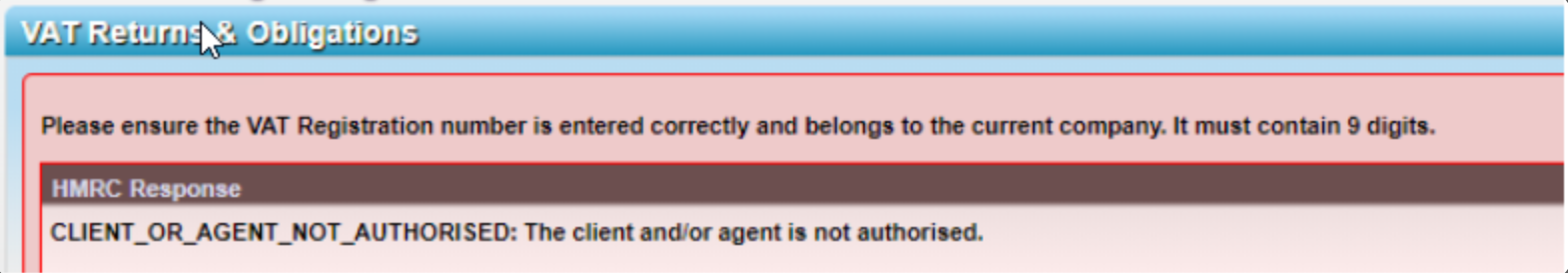

HMRC's Making Tax Digital specification requires financial software developers such as Aqilla to associate HRMC credentials (which are based on one VRN) with a specifc user - so if you are logged on (for MTD) at Company A in Aqilla you will not be able to simply switch to Company B in the same Aqilla instance and run the HMRC VAT MTD report there. If you did, you would get this error message:

The simple workaround to this is to Logoff from MTD as described at CLIENT_OR_AGENT_NOT_AUTHORISED.

The next time you run the HMRC VAT MTD report (in any company) you will be required to authenticate using your HMRC credentials and grant Aqilla authority to interact with HMRC as described at Making Tax Digital.

If you have one instance per company you will not be affected by this. Also if different people manage MTD VAT in different companies in the same instance you will not be affected by this.