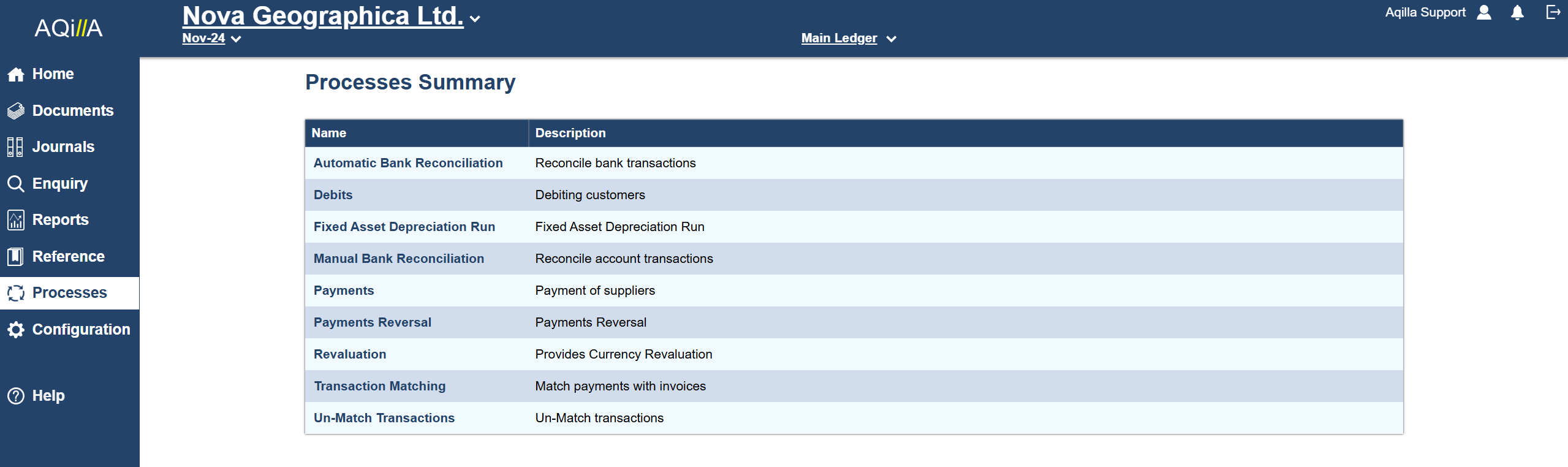

Processes

Introduction to Processes

Year End Process

No special data processing is required at year end but it is necessary to journal from the P&L at the end of year to a balance sheet account such as Retained Earnings. This is usually done by having an equivalent Retained Earnings P&L account. This P&L account should be excluded from your normal P&L reports by assigning it to an Account Category that is not used by your financial reports.

The posting would be in the last period of the financial year and would be something like:

Retained Earnings (BS) | 1,234,567.89 C |

Retained Earnings (P&L) | 1,234,567.89 D |

Note there is no Aqilla menu option for this process which would be carried out using Documents > Miscellaneous.

If you do not complete this step your TB (trial balance) will be out of balance.

Bank Reconciliation

You can compare your own accounting records of bank account activity with statements provided by your bank(s). There are two ways to do this (and note that you should normally use one or the other but not both). You can use Manual Bank Reconciliation to compare printable statements from your bank(s) with your own records - simply ticking off transactions in Aqilla that you find on your bank statements. You can use Automatic Bank Reconciliation to import statement files from your bank(s) into Aqilla - and have the system suggest matches which you can then either accept or amend.

Payments and Debits

You can decide when to pay (or part pay) purchase invoices and make such payments; the ledger (i.e. creditor and general ledger bank accounts) is updated and purchase invoices are updated with payment dates and automatically matched with payment transactions. The Payments process also enables you to download a payment file to submit to your bank.

Similarly, you can generate Debits on debtor accounts (typically if you have customers that pay by direct debit) and the ledger (i.e. debtor and general ledger accounts) is updated and sales invoices are updated with payment dates and automatically matched with payment transactions.

Payments Reversal

After you have completed a payment run, you may want to reverse the process.

The function of Payment reversal will un-match the payments, reverse the values and match the Payments and Reversal together.

You can select a specific payment run from a drop down menu. They are timestamp at the time the payment run, and you can select one or more creditors on the list to reverse.

Fixed Asset Depreciation Run

A Fixed Asset Depreciation Run (also referred to as an FADR) is a process that calculates Depreciation for a selection of Fixed Assets chosen from the Fixed Asset Register.

The Depreciation calculated by the FADR is based on the parameters recorded in the Fixed Asset record (in the Fixed Asset Register).

These parameters include:

The Depreciation Accounts (both Balance Sheet and Profit & Loss) to be used when posting

Whether the asset is Disabled for depreciation (if so, it will be excluded)

The Depreciation Basis (Cost, or Cost less Residual Value) and Depreciation Method

The Lifespan of the asset (determined by a combination of Start Date and End Date or Life in Years)

The Rate of depreciation (determined by Percentage and Accelerator)

Transaction Matching (and Unmatching)

You can match payments to sales and purchase invoices (within an account) using Transaction Matching; in fact you can match any ledger debit to any ledger credit (e.g. sales invoice to sales credit note). If you make a matching error you can correct it using Transaction Unmatching.

You can also use Transaction Unmatching to correct bank reconciliation errors.

Revaluation

You can post revaluation transactions to your ledger(s) at any time to reflect latest currency exchange rates using the Revaluation process. Note you can also do revaluation by reporting.

Processes are automatically filtered by your currently selected company. See Articles > Multi-Company Accounting.