Journal Corrections

About Journal Corrections

Once a journal has been fully posted, the ledger can only be corrected using the Journal Corrections function and then only if Corrections Permitted is set to Yes at Configuration > Ledger Definitions.

The following data can be corrected using the Journal Corrections function:

Transaction References

Transaction Dates

Accounts*

If the transaction has NOT been allocated or has not been reported in a VAT return

Descriptions

Due Dates

Projects

Analysis Attributes

The following data cannot be corrected using the Journal Corrections function:

Values

Periods

Accounts*

If the transaction has been allocated or has been reported in a VAT return

Making a Journal Correction

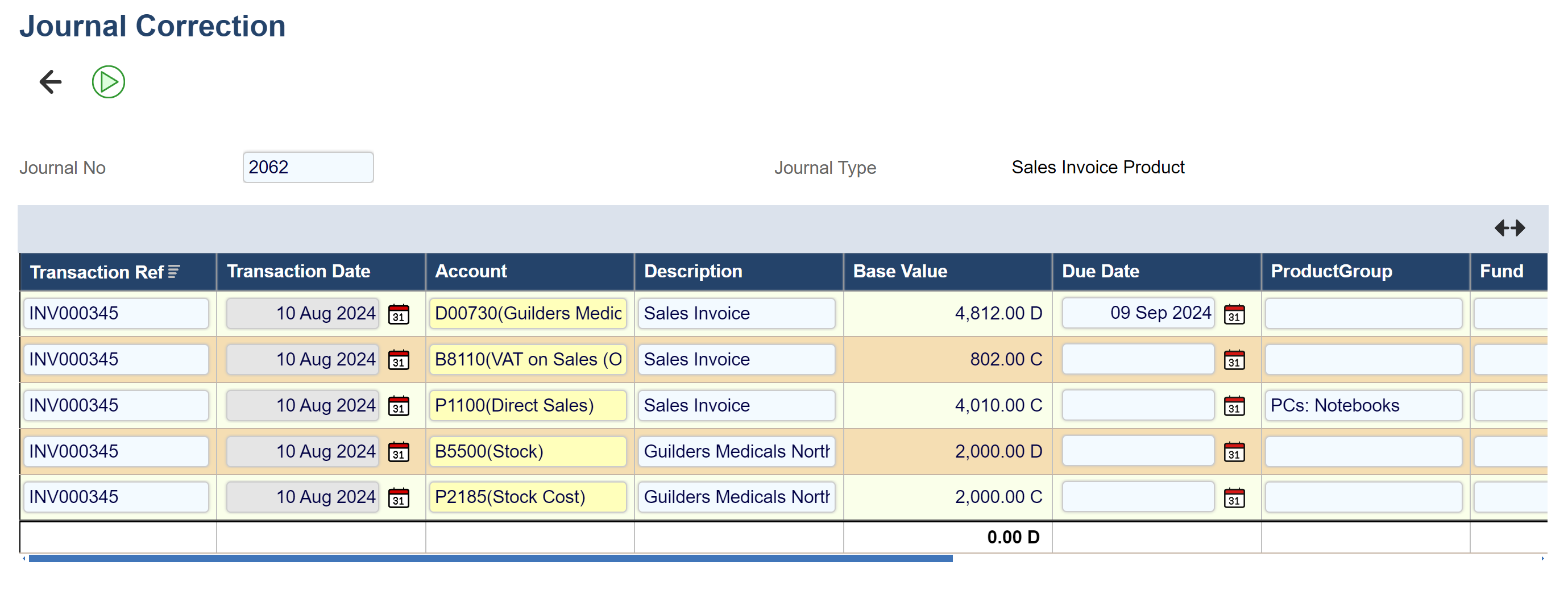

Click on Journals > Journal Corrections. You will be prompted to enter a journal number and when you do, that journal will be displayed for correction.

You can use the horizontal scroll bar to display other fields on the journal line.

When you have made your corrections to fields that are editable, click Post and the posting process will create a new journal consisting of;

a reversal of the original lines that were changed

the changed lines, including all unchanged information from the original line, including allocation details and links to the original source document

A correction journal only includes lines which have been changed.

The reversal and original lines are marked in the ledger so that they can be omitted from or included in enquiries and reports. You can see how this is specified at Enquiries and Reports.

Corrections will be posted in the currently selected period (whatever the period in which the journal being corrected was posted). You should take care WRT the period in which you are posting as your Reports > Financial Reports > Trial Balance may appear out of balance - depending on the setting of Reports Include Corrections at Configuration > Instance Settings.

Corrected transactions are generally hidden in enquiries and reports (in particular, Reports > Statement of Accounts and Reports > Creditor Remittances) to avoid the confusion of showing corrections to the underlying data.

In Enquiries > Accounts and Enquiries > Ledger a column displays the original journal number on any corrected lines.

This function should not be used to correct debtor or creditor accounts on sales or purchase invoice journals; users should use good accounting practice and raise a credit note and then re-invoice. This option should only be used on sales or purchase invoice journals to correct nominal coding - e.g. P&L revenue and cost accounts or other analysis.