Debits

Debits

The Debits function enables you to debit your customers, make modifications to the amounts to debit and then by use of the "Debit" button apply the debit payments to the ledger.

Debits Process

If no filters are applied, the schedule will show all debtor payments that are outstanding irrespective of when they are due and what currency they are in.

The State should be set to “Entered” to prevent transactions that have been “Withheld” or “Forced” to be included.

Once a schedule of debits has been generated, you may suppress the debit payments of individual accounts or by drilling down on accounts into the Payment Status function, mark invoices to be Withheld from payment or split invoices and withhold payment of part of the invoice. Returning to the Debits process will show the amended schedule.

An alternative approach is to use the Payment Status function to select which invoices are to be paid and set their status to “Forced”. Once the schedule has been prepared, use the Debits process, choose the state “Forced” to include only the transactions selected for payment.

If you want to perform debits based on an additional criterion, then “More Selections …” can be used to filter what transactions or accounts to examine. An attribute on the account or range of account codes could be used to distinguish the type of account.

Zero Amount Only Mode

There are situations where the Debit process has not been used to generate payment transactions but payments have been recorded using Bank Transactions, Cash Payments, or Miscellaneous documents. In this situation, there may be a zero amount due but the transactions have not been matched. Selecting this mode provides a method of matching such transactions in a batch rather than using the Transaction Matching function for each account.

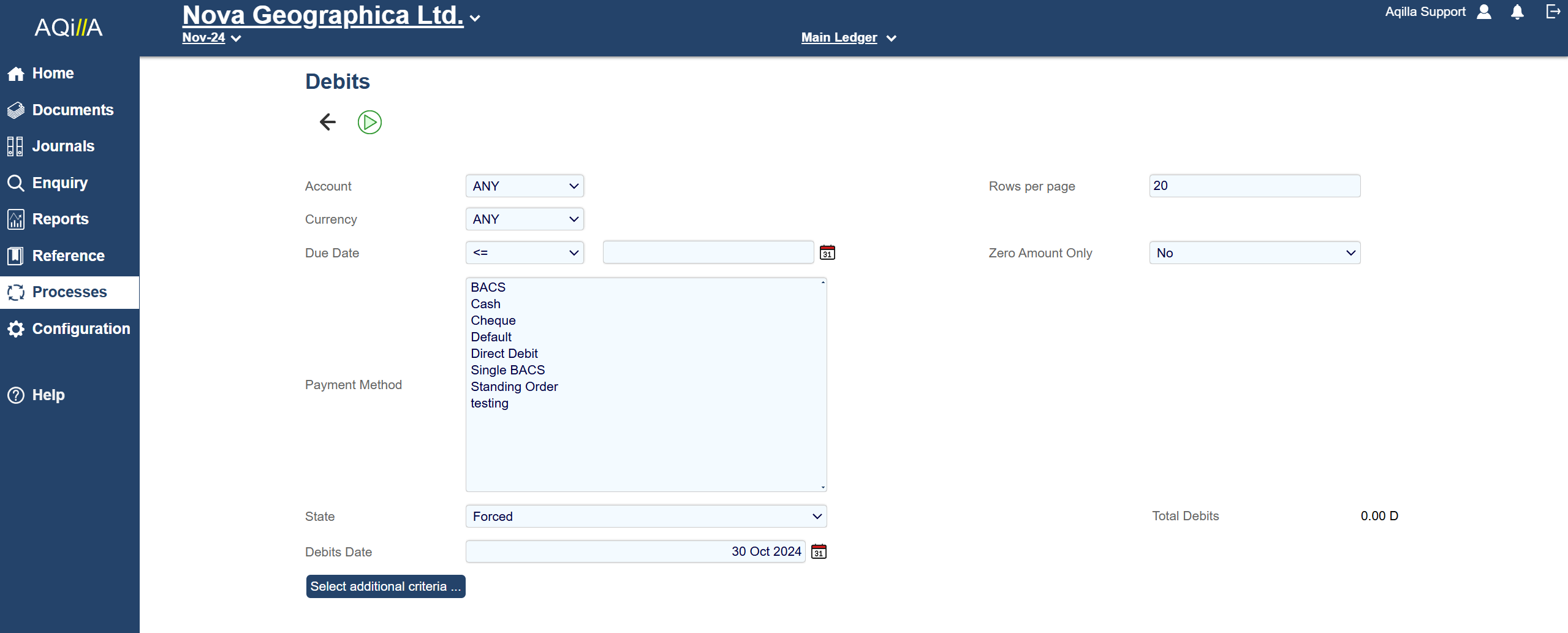

The following filters are available for Debits.

Field | Description |

|---|---|

Account | A specific debtor account. |

Rows per Page | Amount of rows on a page. Default is 20. |

Currency | A specific currency. |

Default Payment Account | Only appears if a specific currency has been selected. Shows general ledger accounts for the currency in question where Payment Account is Yes. |

Due Date | A specific date or; on or before a specific date or; falling within a defined period (e.g. this week, this month). |

Zero Amount Only | If set to Yes only accounts with unmatched transactions but with a zero balance will be displayed. By definition, there is nothing to pay. A Match button will be displayed. Clicking this will match all transactions on all accounts across all pages. |

Payment Method | Payment method as set at Reference > Debtor Accounts; options are Default; Cash; Cheque; BACS; Single BACS, Standing Order and Direct Debit. |

State | Entered (i.e. neither Withheld nor Forced), Payment Forced, Payment Withheld |

Total Debits | Displays the total amount that would be paid if the debit process was run with current settings. |

Debits Date | The payment date to appear on the ledger - you cannot process debits unless this date has been entered. |

More Selections | You can select one further attribute on the ledger, account or project to use as a filter. |

Running the Debits process.

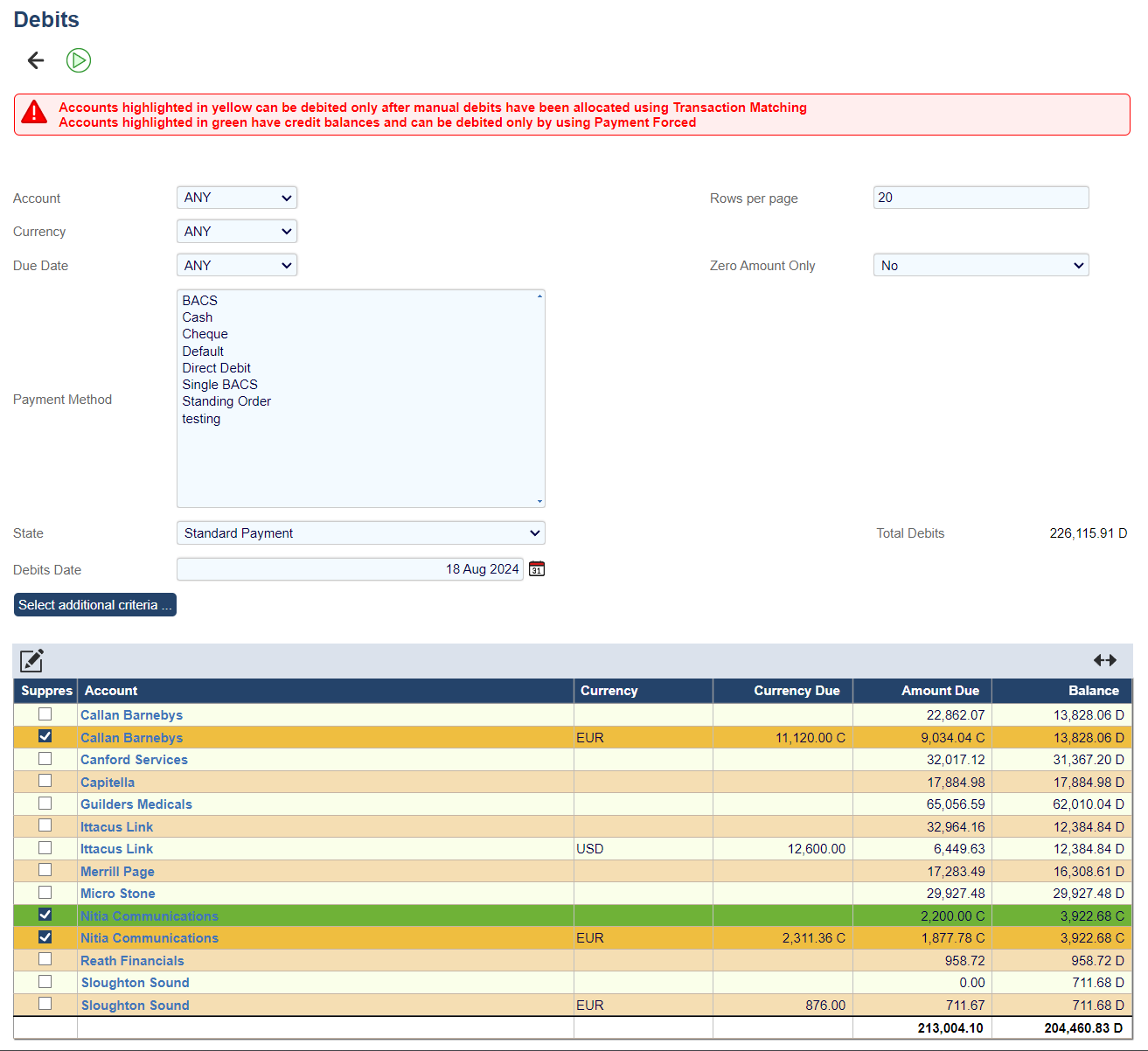

If no filters are applied, you will see an alphabetical list of debtors showing the total gross value of posted invoices by debtor account - but a more typical set of filters would be as shown below (e.g. including a due date). Note that in the following example, the currency has been selected in order to show the Default Payment Account.

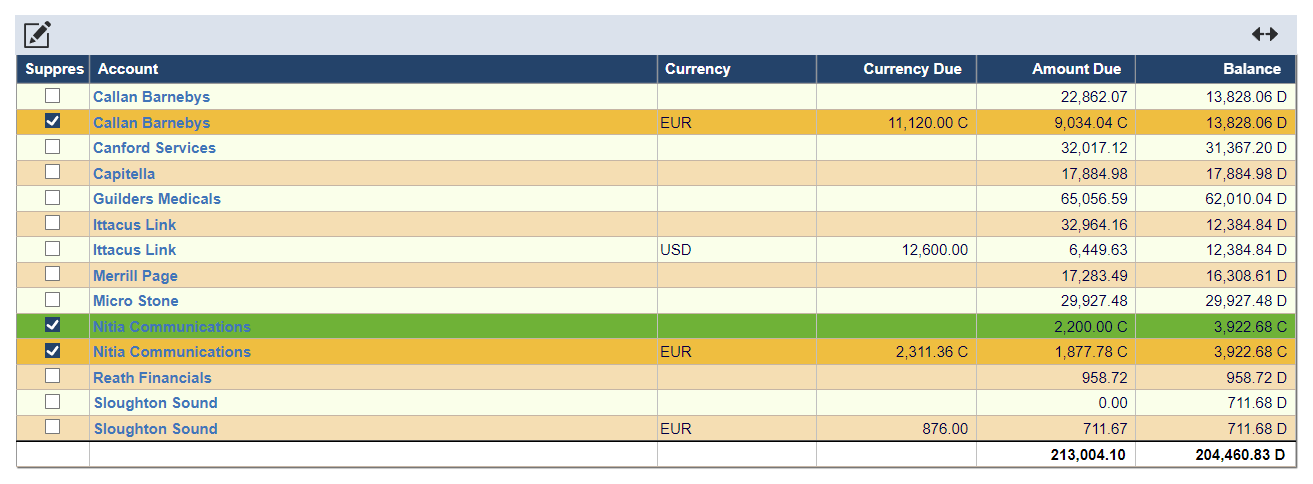

The lines on the Debits list have the following columns (see currency example below):

Field | Description |

|---|---|

Suppress | Check to suppress all payments to this account. |

Account | The debtor account name - click to open Enquiries > Payment Status. |

Currency | The currency code (if not base currency). |

Currency Due | The amount due in the foreign currency (if not base currency) based on selection criteria. |

Amount Due | The amount due in the base currency based on selection criteria. |

Balance | The balance on the debtor account in base currency. |

If you click on an account name you will be taken to Enquires > Payment Status for that account where you will be able to change the state of transactions. This would typically be used during a debits run to split (part pay) a transaction; withhold payment of an invoice that is due or force payment of an invoice that is not due.

Debit

When you have decided which transactions to debit (or partially debit) you can click on the Debit Button

When you click the debit button, the following process will take place for all the accounts that have not been suppressed:

The Amount Due to the debtor will be credited to the debtor account.

The Amount Due to the debtor will be debited to the designated bank account.

If the payment is in foreign currency, and the exchange rate differs between the invoice and payment, a realised exchange difference will be calculated and posted to the debtor account.

The invoice(s), payment and exchange difference transactions are automatically matched together.

Note – Normally a single payment is generated in the debtor account irrespective of the number invoices being paid and the payment and bank transactions will not contain any analysis information from the invoice. A flag called “Analyse Payments” in Instance Settings will generate separate payment transactions in both the debtor and bank accounts for every combination of analysis of the invoices being paid.

Depending on whether analysis information is being captured on an invoice header or the individual invoice lines, the resulting debtor account can result in multiple transactions against a single invoice. When a Statement of Accounts is created, these analysis transactions are combined into a single value for each invoice in the statement.

Likewise, the payment transaction in the bank account may consist of a number of analysis transactions. When using Manual or Automatic Bank Reconciliation, these functions combine the transactions into a single value for each payment to correspond with the amount in the bank statement. An icon is displayed against any line that is a combination of transactions, which can be used to view the breakdown of the individual transactions.

Setting up a General Ledger Account for Debit payments

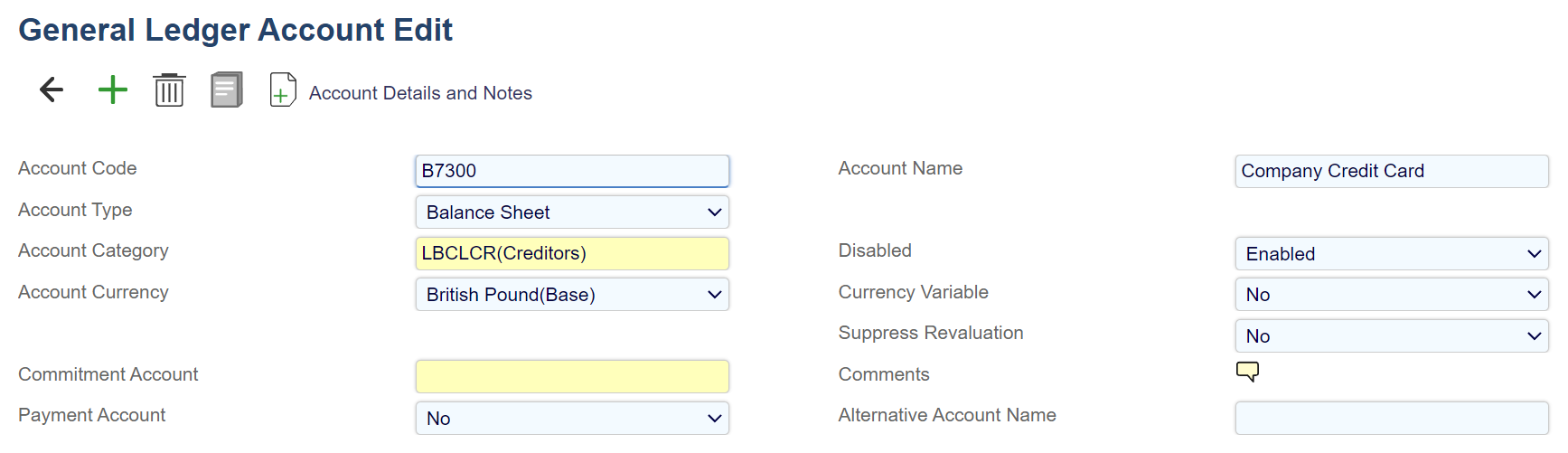

Before you use the Payments process you must create one or more bank accounts at Reference > General Ledger Accounts and set Payment Account to Yes on them as shown on the right:

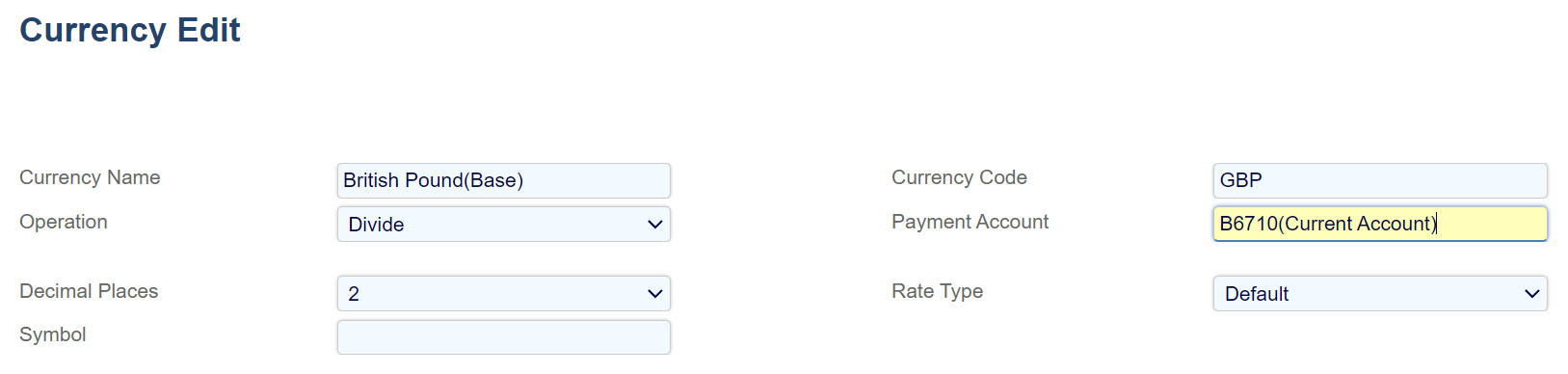

If you trade in multiple currencies (and have a bank account for each currency) you must create a general ledger account for each currency as shown above. You must also create currencies at Reference > Currencies and set the Payment Account for each currency as shown below. The Payment Account defined in the Currency Edit view is the default bank account for that currency (see the order of precedence below).

Note that you can have several possible payment accounts per currency e.g.:

Current A/C - HSBC - GBP

Current A/C - RBS - GBP

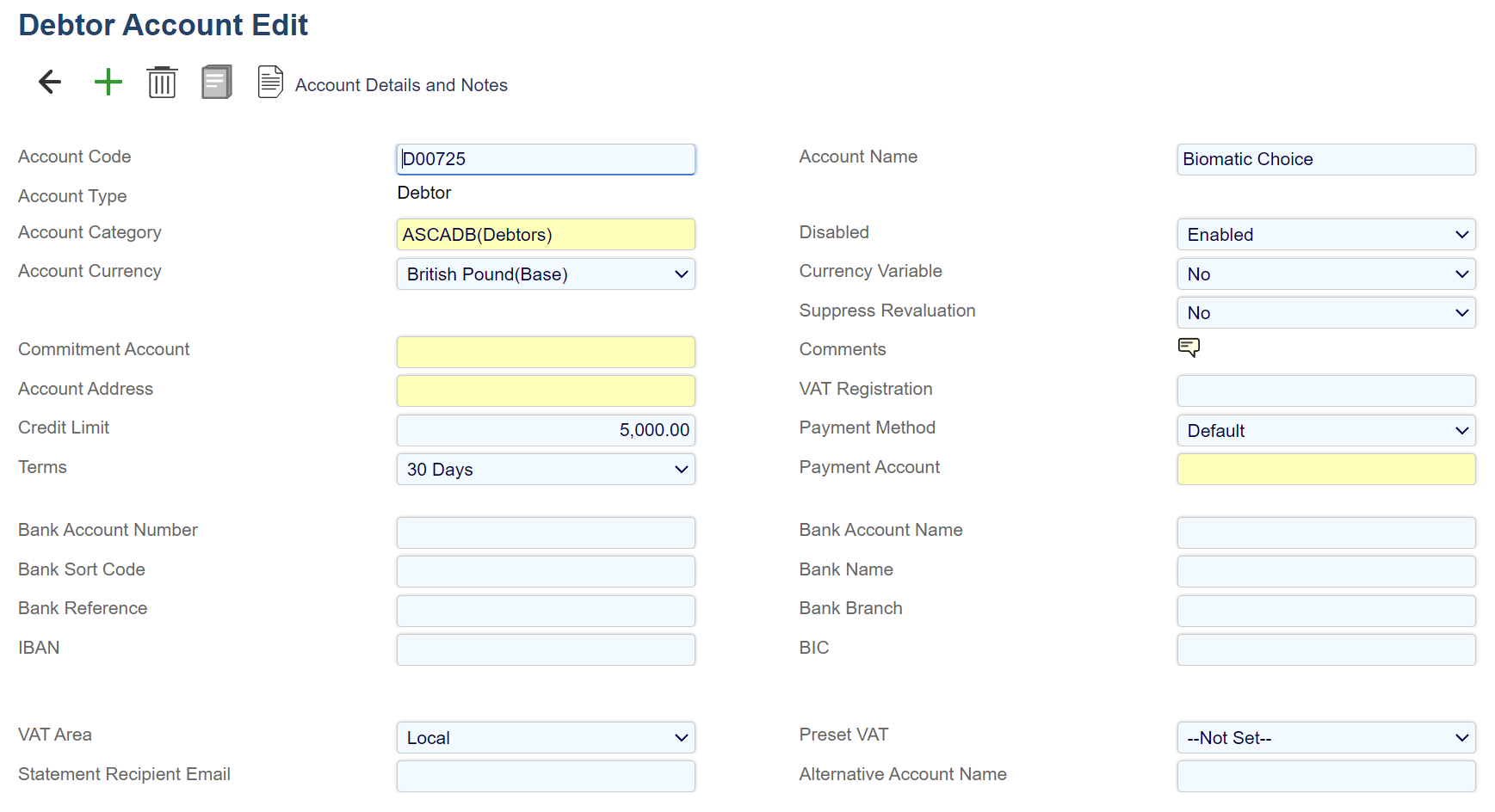

Note you can also specify a payment account against a Debtor Accounts as shown on the right:

The following order of precedence will be used when selecting the bank account to be used by the Debits process:

The payment account held against the debtor in question

The payment account selected during the Debit process - if (1) above is not set

The payment account held against the currency in question - if (2) above is not set

If you only have one bank account with Payment Account set to Yes, that bank account will always be selected as the Default Payment Account. If you only have one such bank account per currency that bank account will always be selected as the Default Payment Account when that currency is selected.

Error Messages and Warnings

You may see these error messages whilst using Debits:

Error | Troubleshooting/Solution |

|---|---|

More than one Bank Account for the Currency 'XXX' is found | Aqilla has more than one general ledger account with Payment Account = Yes and Currency = XXX - you must specify which bank account you want to pay from. |

Bank Account Details for the Account "XXX" are missing or incomplete | Check the bank account details on the account "XXX" |

No Payment Account set up for Creditor Account "XXX" | Check the payment account details on the debtor account "XXX" |