Debtor Accounts

Debtor Accounts

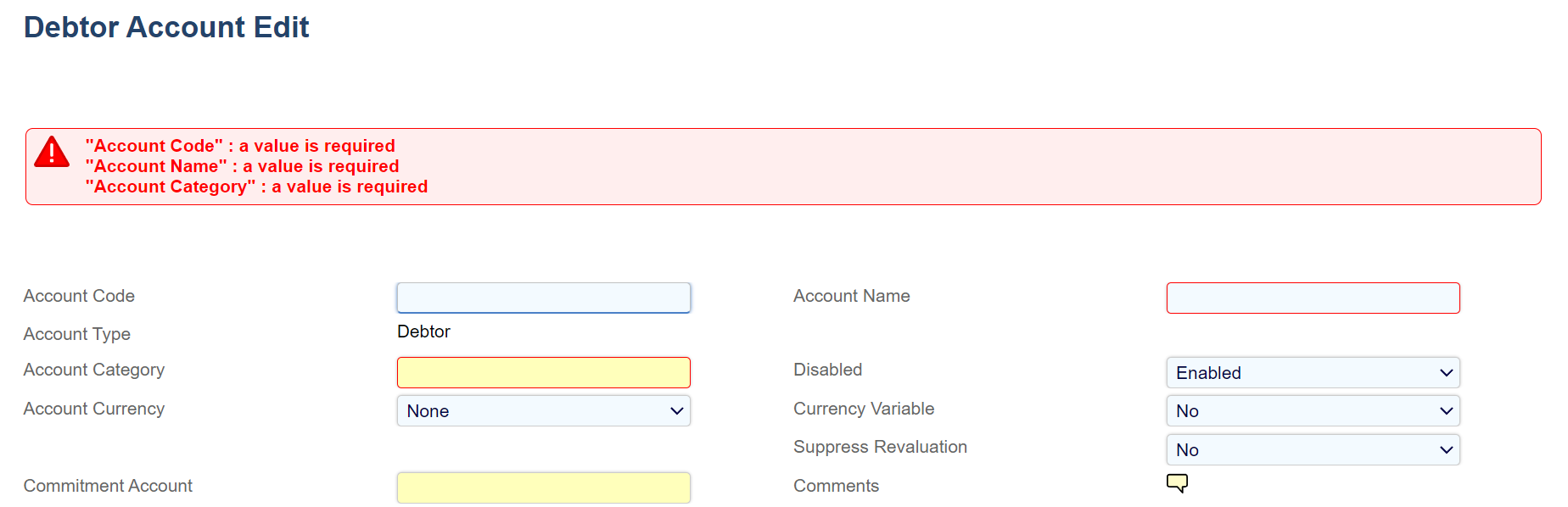

When creating a new debtor you must fill out the field of Account Code, Account Name, Account Category, Terms, VAT Area and Payment Method.

You will be notified by an error message if a default field is missing a value, which will be highlighted in red.

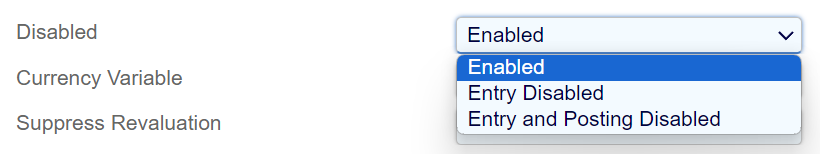

Disabling an Account

You can disable a debtor account by using the drop-down menu.

Entry disabled will prevent new documents from being created under this debtor account.

Entry and Posting disabled will prevent new and current documents from being created and posted.

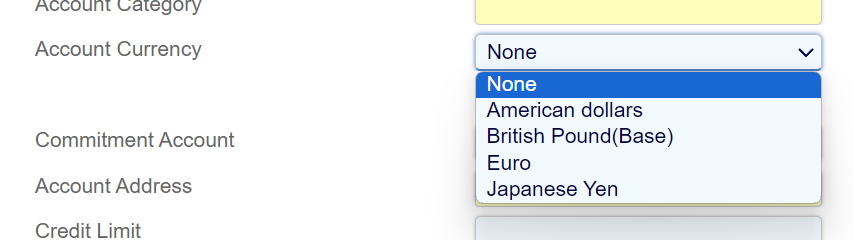

Account Currency

The option allows you to select which currency the debtor account is using. If None is selected it will default to the ledger's currency

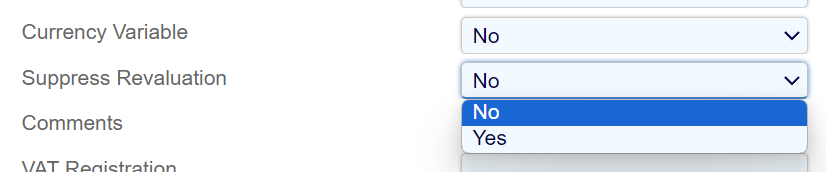

Currency Variable & Suppress Revaluation

Default value for both options are No

Currency Variable = Yes, means that you can pick a different currency under processes, such as Transactions Matching, otherwise only the default currency will be available.

This is useful if you have multiple currencies on an account and you need to match the transactions.

Suppress Revaluation = Yes will remove this account from the revaluation process. Only select = Yes if you do not want Aqilla to revaluate the currency transactions on the account.

Please note that Aqilla does not support multi-currency transaction matching. Transactions has to be in the same currency.

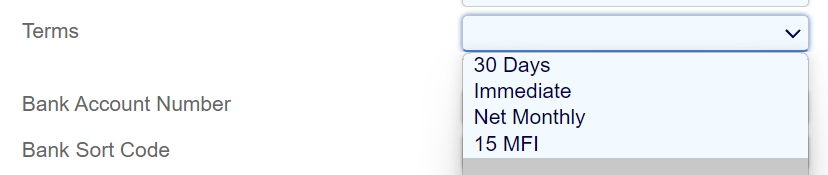

Terms

This option allows you to select the payment terms, as configured under Configuration -> Terms

The Terms selected here can also be printed on a debtor remittance and purchase invoices.

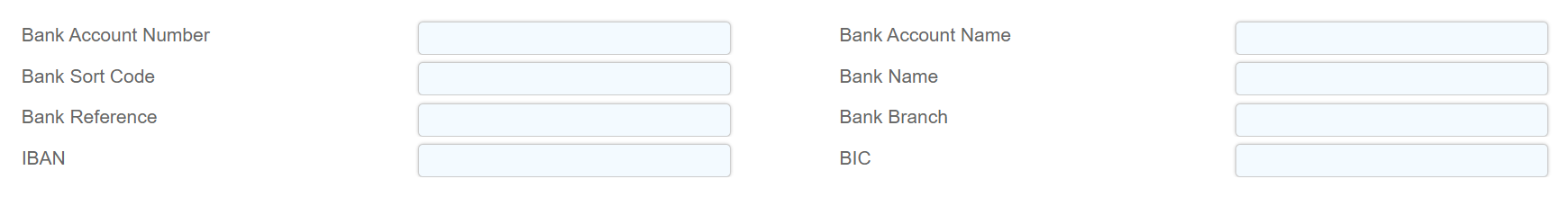

Bank Details

This section of the debtor page stores the payment information of the debtor.

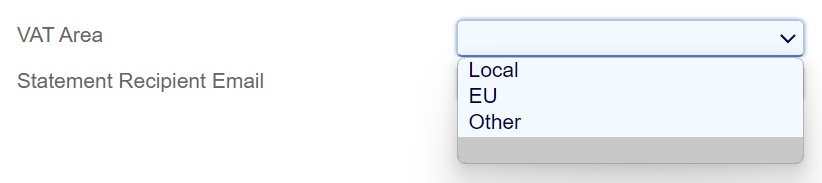

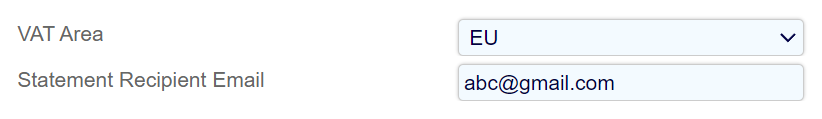

VAT Area

The selection from this field changes where the VAT from the debtor is held within the VAT return.

If you are experiencing problems with your VAT return and certain values are not placed in the correct boxes on the VAT return, this may be the cause.

Statement Recipient Email:

The Statement Recipient email is an important field to fill out if you wish to email a statement of accounts to the debtor.

You can add additional emails by using ; between emails.

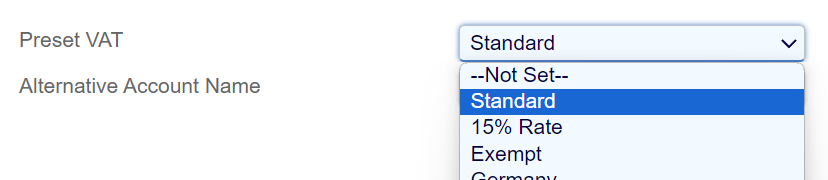

Preset VAT

You can preset a VAT option for a debtor with this drop-down menu.

Please be advised that this will override any other VAT rate available in the instance and you will not be able to select a different type of VAT Rate for the debtor.

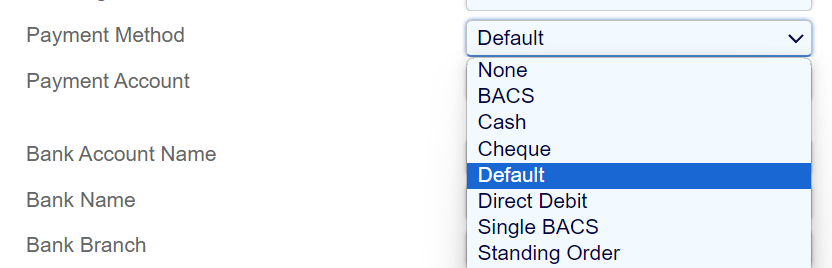

Payment Method

Selects the payment method used by the Debtor. Please note that this directly affect how transactions and payments for the debtor behaves in Aqilla.

BACS and Single BACS are names we have used to identify that the Payment Type will create a bank payment file.

Single BACS indicates that a single value will be posted in the bank account for the whole payment run whereas BACS creates separate transactions for each account being paid.

When Single BACS is used, the payment run creates a single entry in the bank account for all the debtors being paid with the Single BACS payment method.

When BACS is used, the payment run creates separate entries in the bank account for each of the debtors being paid with the BACS payment method.

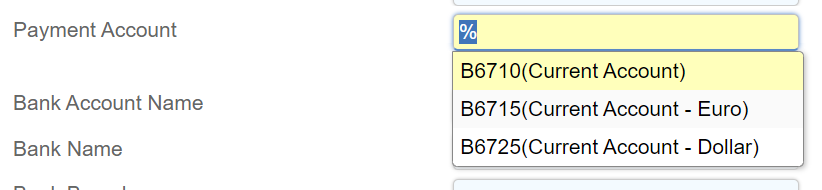

Payment Account & Cost Account:

You can preset certain accounts in the debtor account. This means that you can select the default payment and cost account for the debtor.

These fields are not mandatory, but it is an option if you so choose to use it.

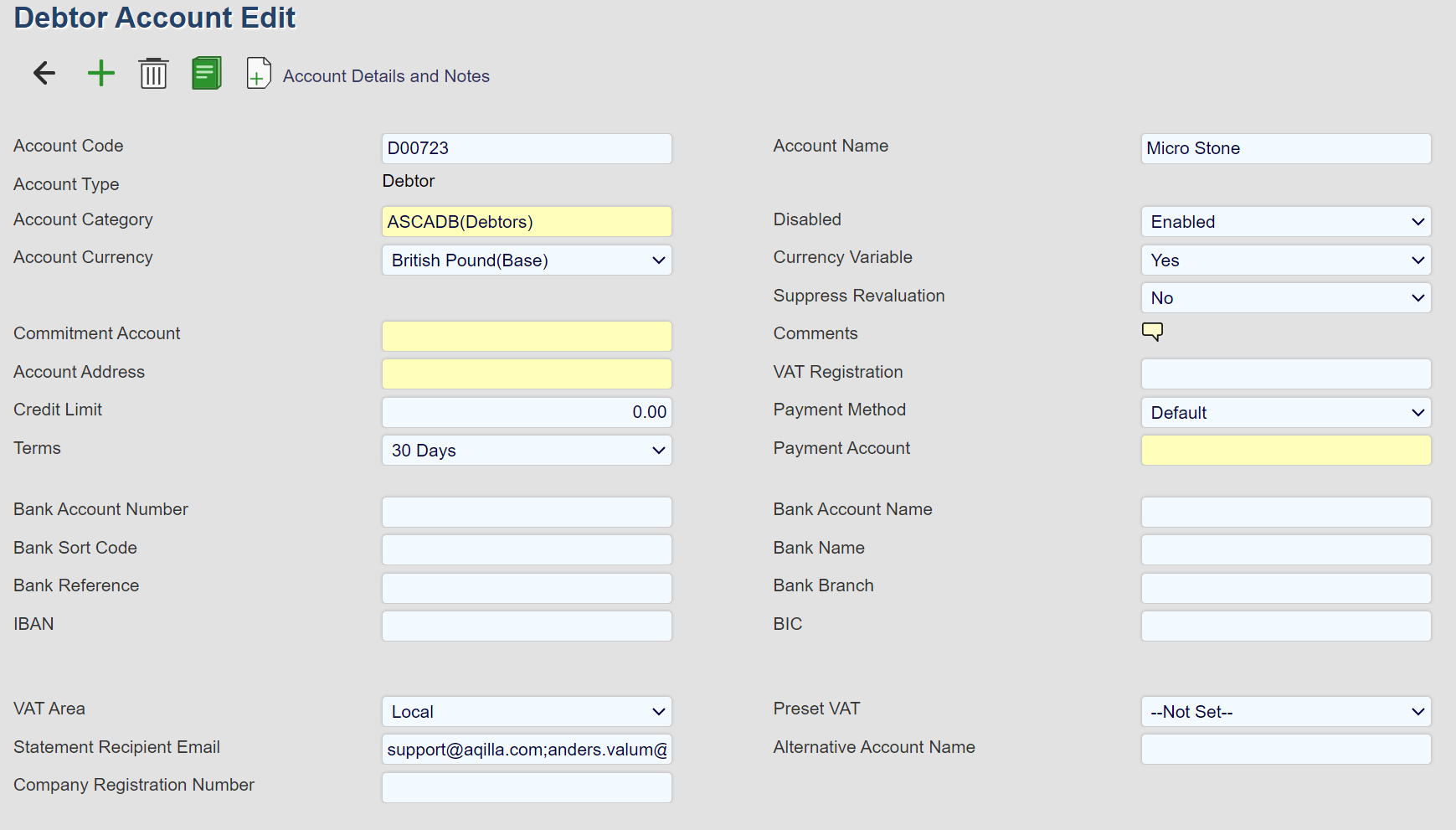

Debtor Account Fields

A sample Debtor Account Edit view is shown below:

Each field on this record is described below. Mandatory fields are highlighted thus.

Field Name | Description |

|---|---|

Account Code | The account code is alphanumeric (30 characters max) and must be unique across all accounts of any type. |

Account Name | The account name is alphanumeric (60 characters max) and must be unique across all accounts of any type. |

Account Type | The account type is always Debtor for this type of account and cannot be edited. |

Balance Forward | Not currently used. |

Account Category | Options are maintained at Configuration > Account Categories ; see Reportsfor an explanation of how account categories are used. |

Disabled | Options are Yes or No. A document referencing a disabled account (either directly or indirectly) can be entered but cannot be posted (or rough posted); the user will receive a warning message if posting (or rough posting) is attempted. |

Account Currency | Options are maintained at Reference > Currencies. The option None is used by default - in which case the Account Currency is the Base Currency . |

Currency Variable | Not currently used on this type of account. |

Currency Rate Group | Not currently used. |

Suppress Revaluation | Options are Yes or No . If set to Yes the account is excluded from Processes > Revaluation . See Multi-Currency Support for more information about revaluation. |

Commitment Account | Not currently used on this type of account. |

Comments | This is a free text field with practically unlimited content. See Navigation > Notes for more information. |

Account Address | Use this field to select a record defined at Reference > Customers . The address at the selected record will be used in statements during Reports > Debtor Statements . You should not enter anything into this field unless more than one customer record references the debtor account in question. |

VAT Registration | Held for information only. |

Credit Limit | Held for information only. |

Payment Method | Held for information only. |

Terms | Options are maintained at Configuration > Terms . This field is used to calculate a payment due date based on a sales invoice date. The proposed payment due date can be over-ridden by the Aqilla user who enters the sales invoice document. |

Payment Account | The bank account that will be used to debit the debtor; this field is optional but if entered it will over-ride all other possible bank accounts - see Processes > Debits for more details. TBC |

Bank Account Number / IBAN | The debtor's bank account number or IBAN - e.g. 12345678. |

Bank Account Name | The debtor's bank account name - e.g. CustomerName Ltd. |

Bank Sort Code / BIC | The debtor's bank sort code or BIC - e.g. 123456. |

Bank Name | The name of the debtor's bank - e.g. Barclays. |

Bank Reference | A reference code for the debtor's bank - e.g. ABC123. |

Bank Branch | The branch of the debtor's bank - e.g. 21 High Street, Guildford. |

VAT Area | Options are UK, EU and Other . Defines where VAT is reported on the VAT100 report. See Reports > VAT 100 Report . |

VAT Not Reported | Options are Yes or No . If set to Yes , the VAT rate is set to the Not Reported VAT rate on a sales invoice. See Configuration > VAT Rates . |

Statement Recipient E-Mail | The e-mail address of the person (or role) at the debtor who receives statements - e.g. accounts@customername.com. For multiple Email recipients separate the email addresses by semicolons. For example: jimbrowne@abc.com; millamoyes@abc.com. The combined length of the email addresses must not exceed 255 characters. |

Alternative Account Name | An alternative name for the debtor account which could be used in reports. |

Company Registration Number | Please enter the Company Registration Number here. This number is a unique identifier issued to the company at the time of registration. It is essential for legal and administrative purposes and will be used to verify the company's official status and information. |