Manual Bank Reconciliation

Manual Bank Reconcilliation

The Manual Bank Reconciliation process is used to manually reconcile transactions recorded in bank account(s) within Aqilla against printable statements provided by your bank(s).

If you are using Manual Bank Reconciliation you should not also use Automatic Bank Reconciliation. When you use Automatic Bank Reconciliation you upload your bank statement to Aqilla and match bank statement lines to transactions in Aqilla. If you have marked transactions in Aqilla as reconciled (using Manual Bank Reconciliation) they will no longer be available to match against bank statement lines - which you will therefore be unable to reconcile.

During initial system set-up (and if you are intending to use Automatic Bank Reconciliation) you may need to use Manual Bank Reconciliation temporarily to reconcile bank transactions or opening balance(s) that have been manually entered into Aqilla (prior to statements that have been / will be uploaded using the Automatic Bank Reconciliation process). If you are fully using Automatic Bank Reconciliation it is good practice to hide the Manual Bank Reconciliation option from the Processes menu - ask your Aqilla consultant or Aqilla Support to do this for you.

1. Bank Accounts

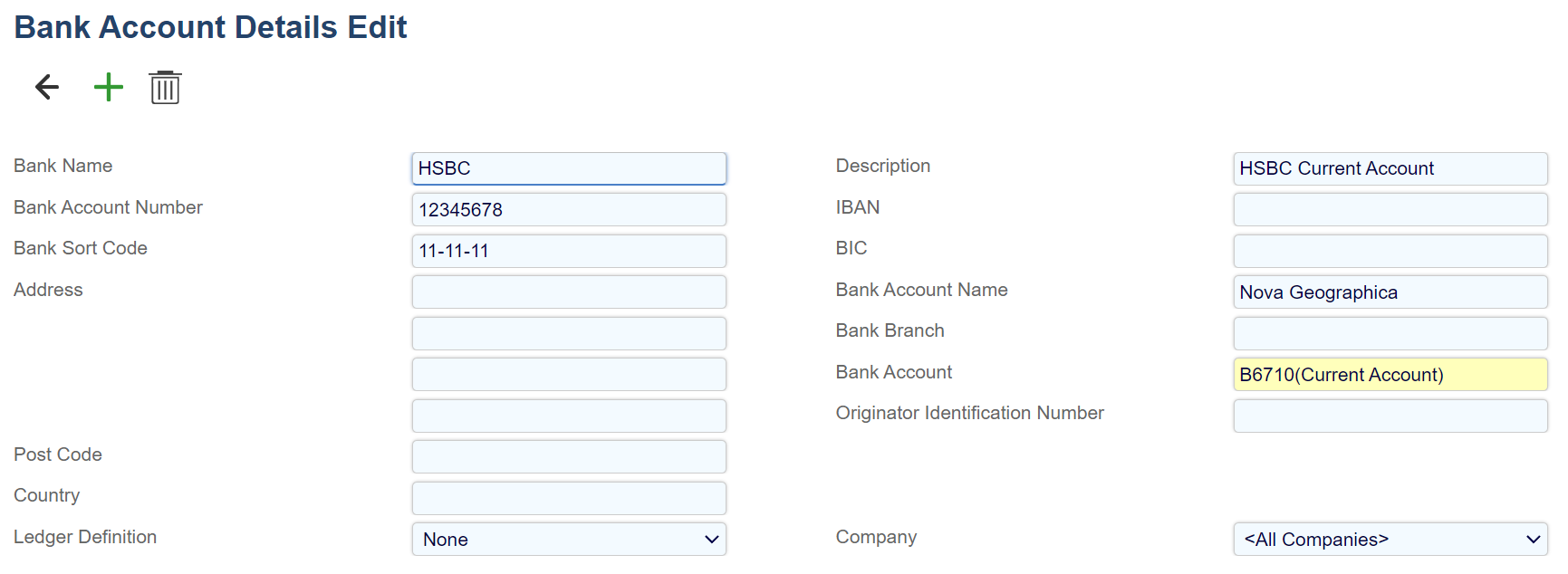

Before you use the Manual Bank Reconciliation process you need to create bank account(s) at Reference > General Ledger Accounts (make sure you select a currency unless your bank account is truly multi-currency) and at Reference > Bank Account Details. Also make sure you link from Bank Account Details to the associated general ledger account as shown on the right:

2. Reconciliation

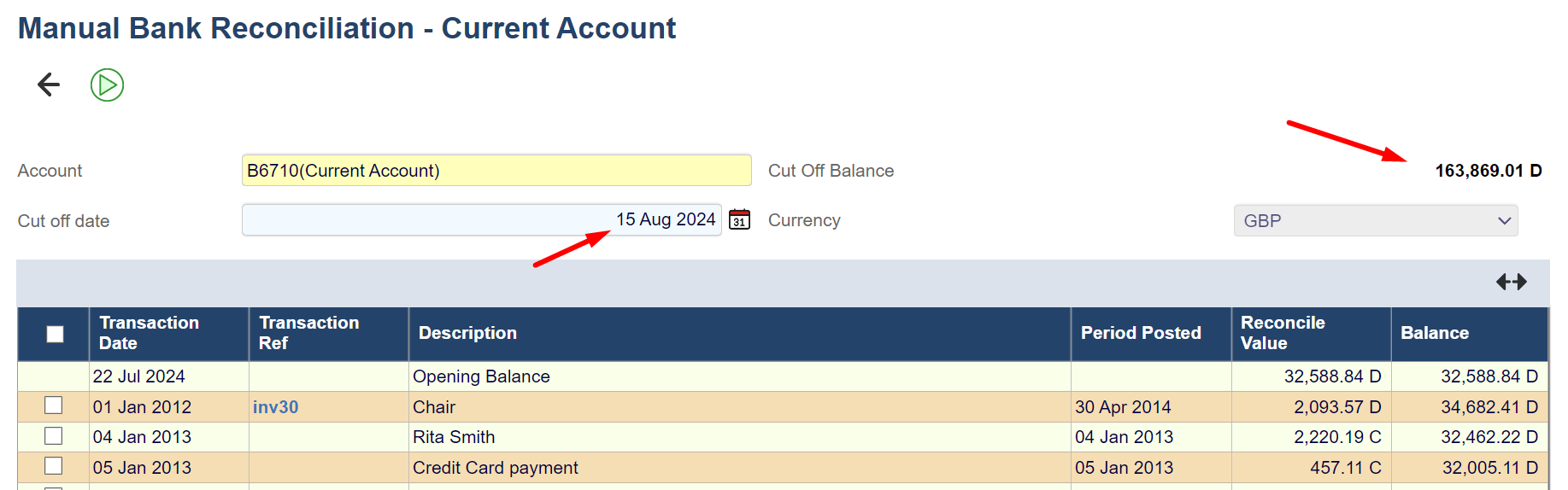

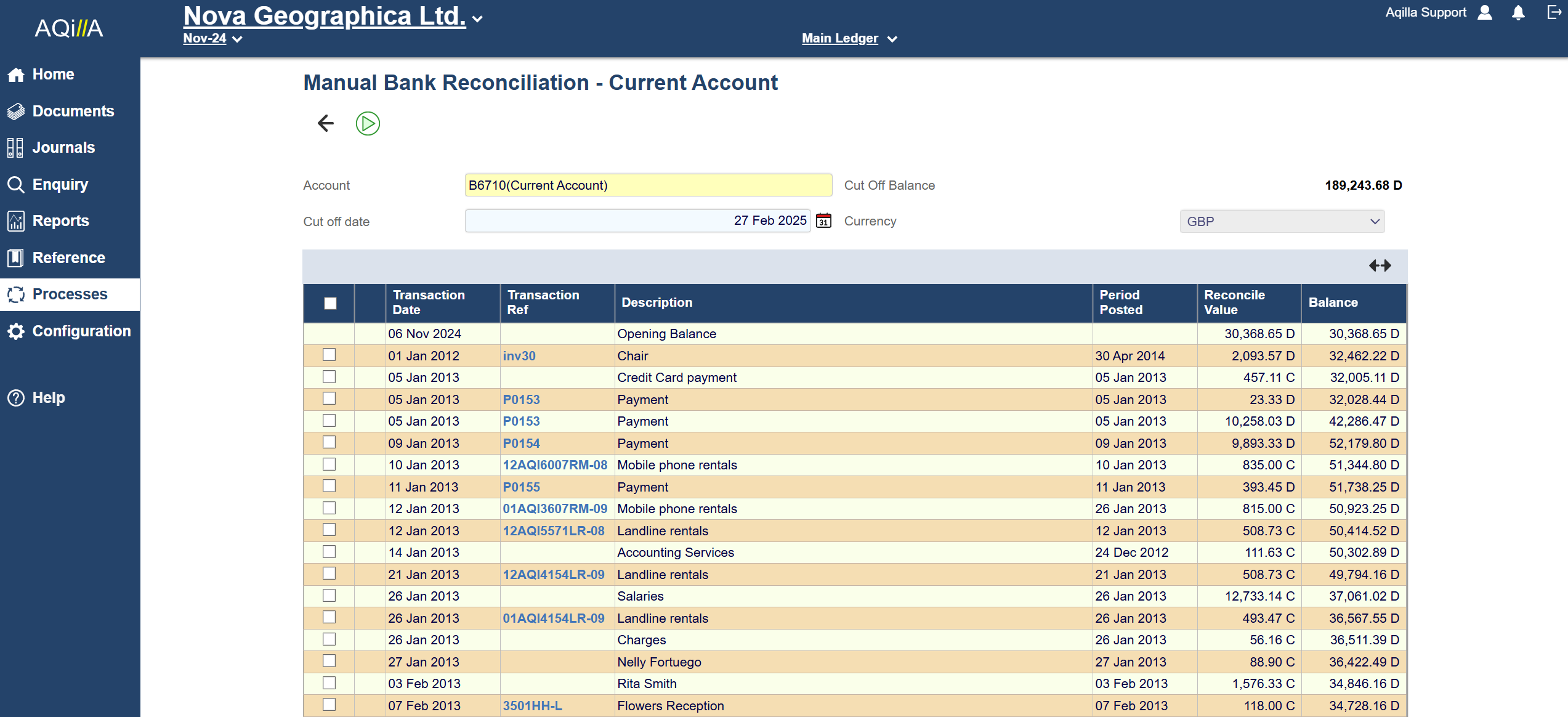

Start by entering the selection criteria which are:

Account | Cut Off Date | Currency |

|---|---|---|

Only general ledger accounts connected as shown above will be available for selection. | Unreconciled transactions up to and including this date will be displayed. | The currency you wish to reconcile - only applicable if you have a truly multi-currency bank account. |

Cut Off Balance is a calculated field. There are two calculations involved:

Opening Balance is the sum of all reconciled transactions (i.e. transactions with a Matching ID). Note that the transaction date of the opening balance is the transaction date of the most recently reconciled transaction. Note that if there are some unreconciled transactions with earlier dates this can lead to some inconsistencies. For example if in the screenshot (below) the transaction on 08 Jun is reconciled but the transaction on 03 Jun is not, the display will show:

08 Jun 2017 Opening Balance 2,147.20

03 Jun 2017 Virgin Trains 3,066.00

15 Jun 2017 Virgin Trains 1,686.30

Cut Off Balance is the sum of all transactions with a Transaction Date up to and including the Cut Off Date.

If the bank account statement agrees with the transactions entered into Aqilla, the Cut Off Balance will correspond with the bank statement total. Note that you will need to enter some bank transactions (e.g. bank charges and interest paid/received) by reference to the bank statement itself. Such transactions can be entered using Documents > Bank Transactions e.g.:

You can drill down to transaction details by clicking on the Transaction Ref.

Select the transactions you wish to reconcile by clicking the checkbox in the left-hand column - the Reconcile button will then appear. When you click the Reconcile button the bank transaction(s) you have checked will be marked as reconciled in the system and given a Matching ID and Matched Timestamp.